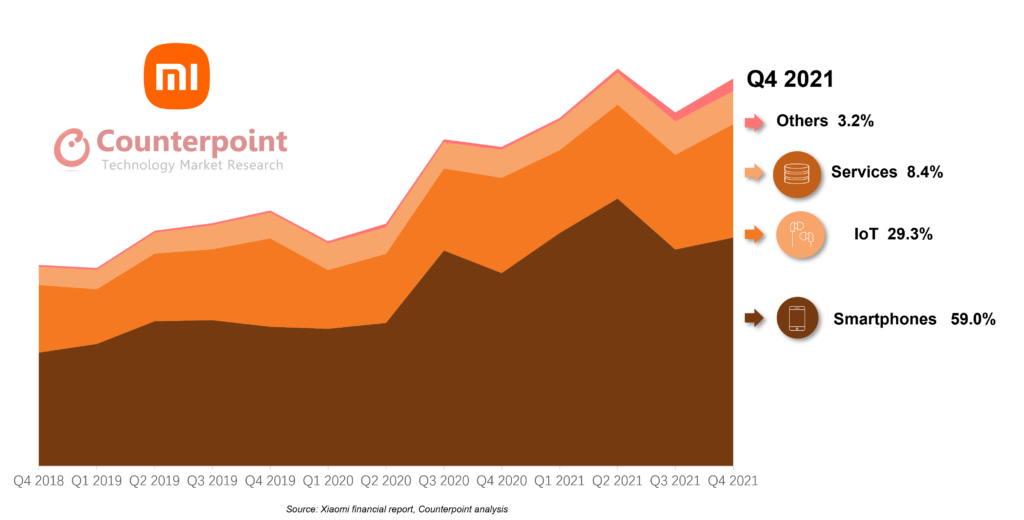

With a 9.6% sequential increase in total revenue in Q4 2021, Xiaomi has partially recovered from its underwhelming performance in Q3. In terms of segment performance, its smartphone revenues increased 18.4% YoY. IoT and Lifestyle products and Internet services also saw 19.1% and 17.7% YoY increases respectively.

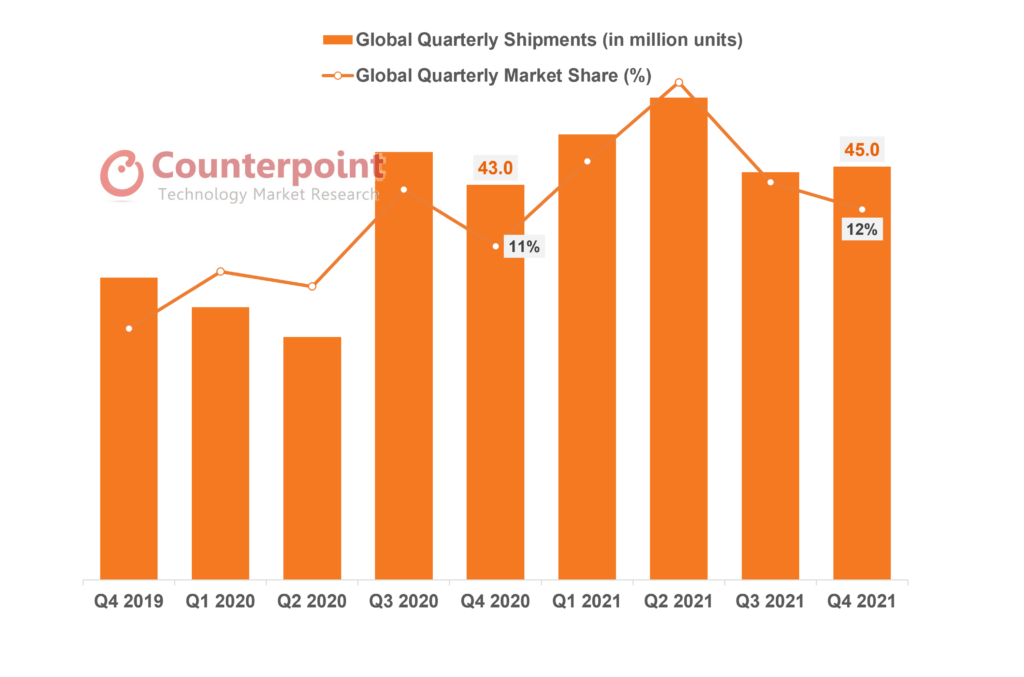

The company’s latest financial data is also in line with Counterpoint’s Market Monitor data, which shows Xiaomi’s smartphone shipments increased 4.7% YoY and 1.4% QoQ in Q4 2021. The slower increase in smartphone shipments growth as compared to revenue growth illustrates that Xiaomi has made fairly good progress upgrading its portfolio and improving its smartphone average selling price (ASP). Correspondingly, Xiaomi’s gross margin from smartphones improved from 8.7% in 2020 to 11.9% in Q4 2021.

Xiaomi’s Global Shipments and Market Share, Q4 2019-Q4 2021

Commenting on Xiaomi’s smartphone sales, Senior Analyst Ivan Lam said, “Counterpoint’s Market Monitor data shows that Xiaomi’s smartphone shipment growth has underperformed the global market total in Q4 2021. Key component shortages, especially in LTE, constrained Xiaomi’s low-end smartphones sales. However, the increase in ASP helped Xiaomi to keep up with revenue growth. The company is moving in the right direction as it has tried to contain the share of entry-level smartphones.”

Xiaomi’s IoT and Lifestyle products segment saw record performance in 2021, with revenue coming in at RMB 25 billion in Q4, up 19% YoY. Commenting on the performance of this segment, Senior Analyst Yang Wang said, “IoT and Lifestyle products are becoming more and more important to leading smartphone OEMs. Those products can be sold into the same channels as smartphones in most regions, and can therefore be boosted by the same marketing halo effect, such as bundled sales, promotions and new product launches. Notably, Xiaomi’s TVs, laptops, tablets, wearables, and home appliances saw good sales, due to Xiaomi’s affordable pricing strategy.”

Last but not least, Xiaomi’s internet services revenue reached a record RMB 7.3 billion in Q4 2021, translating into a growth of 17.7% YoY. This was attributed to the advertising business, as well as a 79.5% YoY growth in overseas markets.

Xiaomi’s Global Revenue Mix and Share, Q4 2018-Q4 2021

During the earnings call, Xiaomi disclosed that revenue from the smartphone segment grew 37%, and was still the biggest contributor to the company in 2021 at 63.6%. Smartphones’ cost of sales remained stable at 56.0% in 2021, as compared to 56.5% in 2020. The cost structure has thus improved by pushing up the ASP.

Internet services made 8.6% of total revenue in 2021. Commenting on Xiaomi’s internet services segment, Research Analyst Archie Zhang said, “Xiaomi’s internet services segment has shown decent growth momentum. Notably, overseas services revenues grew 18.8% YoY in 2021. However, Xiaomi faced several challenges, including more stringent regulations around targeted advertising and privacy, and a weak home market due to sluggish performance of the big internet companies in China.”

Xiaomi closed the buy-out of the 50.09% stake of Zimi International Incorporation that it does not already own. By bringing the ‘ecosystem’ company under its control, Xiaomi can boost its offers in accessories such as mobile power banks, wireless chargers, and smart home accessories. Xiaomi also acquired Deepmotion Tech Limited, a company specializing in advanced driver-assistance systems (ADAS) and automated driving applications. Xiaomi announced that the mass production of its smart electric vehicle will officially begin in the first half of 2024.