The service robotics industry has grown quickly in recent years, spurred on by advances in robotics technology and artificial intelligence (AI), and maybe set to help alleviate some of the labor issues across multiple industries.

Service robots, as covered in the new IDTechEx report “Service Robots 2022-2032: Technologies, Players & Markets”, can be used to automate several industries including logistics and delivery, cleaning, agriculture, underwater exploration, food service, and social interaction. Although each application presents advantages, their stages of commercialization vary significantly with some being well-developed, attracting hundreds of millions of dollars in annual revenue, whereas others, despite their huge potential, are still emerging and may only reach full commercialization by the end of the decade.

Will regulations be a major barrier to the applications of service robots? Is COVID a chance for them to be loosened?

Compared to traditional industrial robots that work in relatively well-controlled environments, many service robots need to deal with more complicated scenarios such as limited visibility in the deep ocean for underwater robots, difficult terrain in farmlands for agricultural robots, and human intervention for delivery robots along with many other challenges. To ensure that they can operate safely and minimise the risks, regulations, and restrictions (e.g., data privacy policy, robot size restrictions, maximum running speed, and many others) are usually enforced. These regulations limit the commercialisation and scaling of some market players. An example is social robots. Social robots are associated with many data privacy policies as they could easily collect information when interacting with people. To avoid a data breach, manufacturers are required to make sure that their products are in compliance with data privacy regulations. Another example is delivery robots. Although autonomous driving has been accepted by many people, fully autonomous mobile delivery robots are still at their small-scale trial stage due to the lack of users’ trust and regulations from departments of transportation in many countries. However, the recent COVID pandemic has provided an avenue to loosen some of the regulations. During the past three years, COVID has caused a surge in the demand for contactless and autonomous delivery. Given the massive demand, regulators have also started to loosen some of the restrictions, and IDTechEx believes that this trend will continue as many countries have published documents implying that more logistics robots will be legally approved.

Ease of use, low technical complexity, and low price = large adoption?

Among delivery robots and cleaning robots are two leading applications due to the following reasons:

- Technical simplicity – unlike other service robots (e.g., underwater robots, kitchen robots, agricultural robots, etc.) that work in a complicated environment with many uncertainties, cleaning robots and logistics/delivery robots are primarily designed to work in a well-controlled indoor environment including empty shopping malls, warehouses, and homes. The well-controlled environments enable simpler design, ease of use, and high robustness, thereby encouraging market uptake.

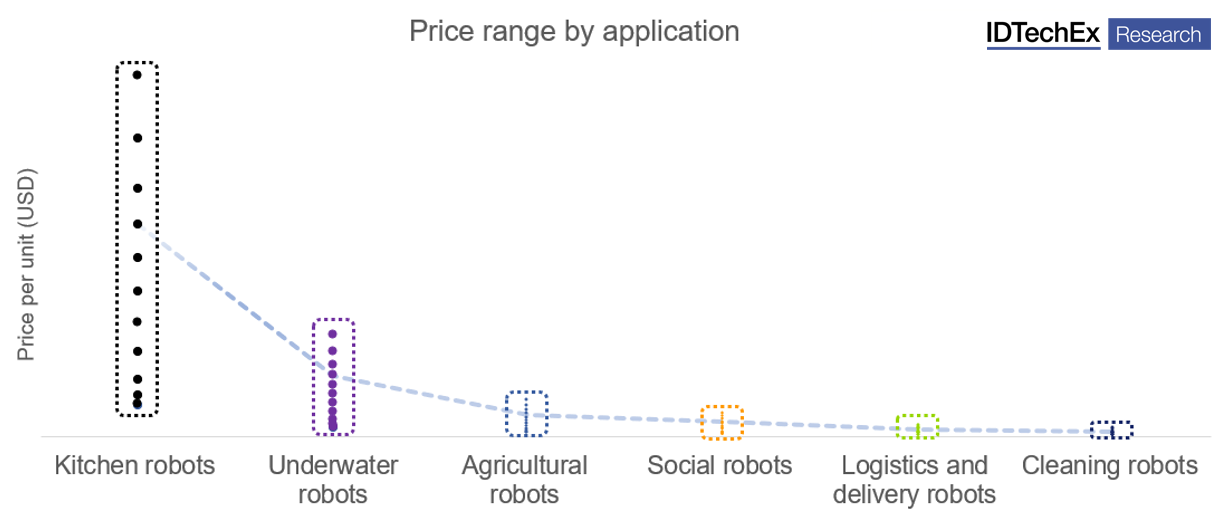

- Low price – because of the low technical complexity, manufacturers would be able to use cheaper components and simpler technologies to reduce costs, and prices, and increase affordability. The low prices significantly lower the barrier to adoption, thereby accelerating the market uptake.

Price ranges of different service robots.

Concluding Thoughts

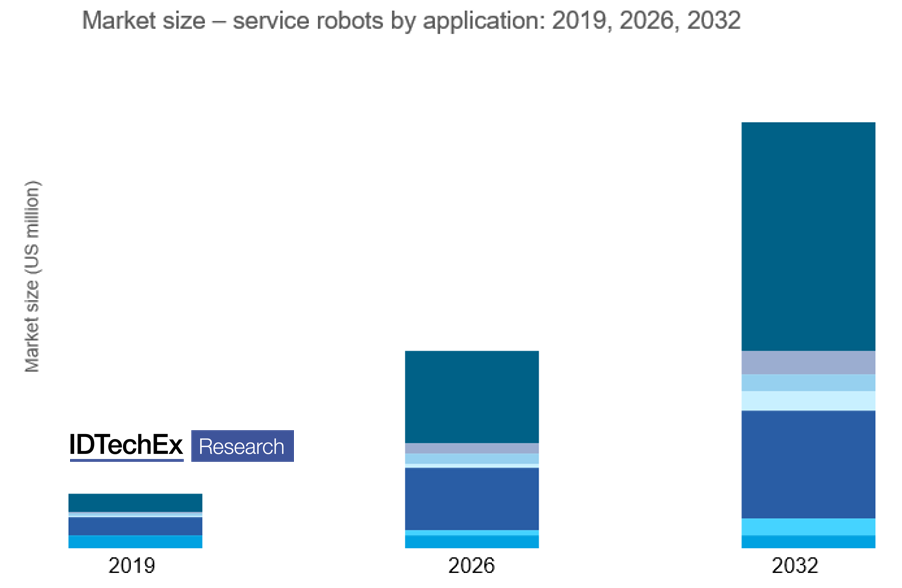

Despite the potential to automate several industries, service robots as a whole are still relatively early in commercialization due to regulations among other challenges. However, COVID has accelerated some service robot applications, and many authorities began to loosen restrictions, allowing some service robots to be utilized in reality. Aside from regulations, another consideration for the market uptake of service robots is their technical complexity and price point. Working in a well-controlled environment typically leads to low technical complexities and low prices. Therefore, it is not a surprise to see that logistics/delivery robots and cleaning robots have the largest markets and will continue to be in a dominant position over the next 10 years.

“Service Robots 2022-2032: Technologies, Players & Markets”, provides ten-year market forecasts by application area and region.

To address these problems, the new IDTechEx report “Service Robots 2022-2032: Technologies, Players & Markets” includes emerging technologies, and stages of development for each application, regulations around social robots and logistics robots, and financial impacts on the future trends. For each type of robot, a deep dive is taken into each application area along with company examples. A 10-year granular market forecast is given for each category of robot, including social robots, delivery and logistics, disinfection, and cleaning, agricultural, kitchen and restaurants, and underwater robots.