Indonesia’s smartphone market grew 5% YoY in 2021 to reach its highest ever shipments in a single year, according to Counterpoint Research’s Monthly Indonesia Channel Share Tracker. The growth was due to pent-up demand during the first half of the year, good performance of mid-tier smartphones and 5G adoption driving some of the users to upgrade their devices. The Indonesian economy also started to recover in the second half of 2021 as the restrictions and lockdowns were relaxed, triggering a rebound in the demand for mobile phones.

Commenting on the Indonesian smartphone market, Research Analyst Tanvi Sharma said, “Brands like OPPO brought bundled offers and campaigns like Joy-Full, which provided benefits and after-sales promos. There were also strategic partnerships between major OEMs and e-commerce players, like between vivo and JD.com. Had it not been for the component shortages during the second half, the growth would have been even higher. To meet the challenge, brands focused on their mid-tier portfolios and increased the selling price in some cases to pass on the increased cost to the end consumer.”

Commenting on the Indonesian smartphone market, Research Analyst Tanvi Sharma said, “Brands like OPPO brought bundled offers and campaigns like Joy-Full, which provided benefits and after-sales promos. There were also strategic partnerships between major OEMs and e-commerce players, like between vivo and JD.com. Had it not been for the component shortages during the second half, the growth would have been even higher. To meet the challenge, brands focused on their mid-tier portfolios and increased the selling price in some cases to pass on the increased cost to the end consumer.”

The online portion of total shipments accounted for 18% in 2021. There was an online push in the country by major brands during shopping festivals such as 10.10, 11.11 and Harbolnas 12.12. In addition to providing attractive deals, campaigns were also held to support micro, small and medium enterprises (MSMEs) in developing businesses in the digital realm. However, offline retail continued to dominate the shipments. Erajaya, the country’s biggest distributor, opened 38 outlets simultaneously to expand its coverage area.

5G smartphone shipments took an 11% market share in 2021, compared to just 1% in 2020. With the commercial rollout of 5G services in the country, 5G handsets are gaining popularity. It is expected that the initial use cases such as enhanced mobile broadband (eMbb) and fixed wireless access (FWA) will enrich the internet experience of consumers, contributing to faster adoption of the technology. To drive further expansion of 5G, communication service providers are expected to form strategic alliances with other ecosystem players to bring innovative services to attract consumers.

Market Summary:

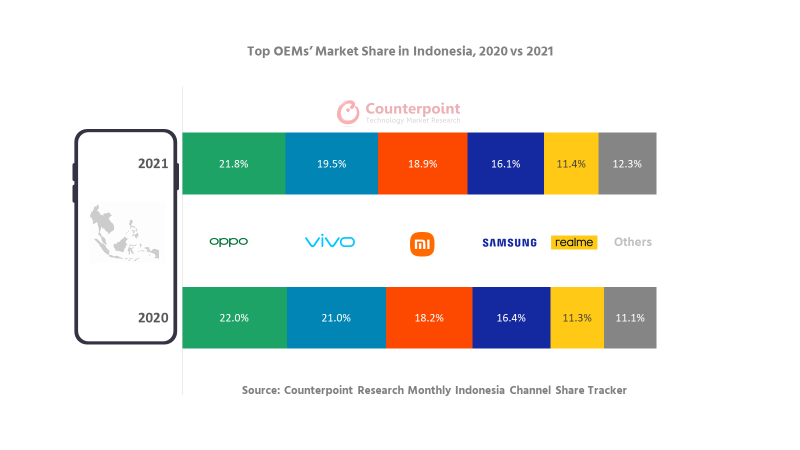

- OPPO dominated the Indonesian smartphone market in 2021 by capturing a market share of 22%. Its A series played a big role in this growth. The brand remained committed to ensuring product availability through both offline and online channels.

- vivo’s growth was catalyzed by its diverse product portfolio covering all segments. The popularity of the Y series ensured its growth while the mid-tier V series did well during the year. The premium X series also got positive reviews and mind share.

- Samsung did well in 2021 as it expanded its product portfolio in the affordable segment, which is grabbing more attention from the consumers. Samsung is also revamping its channel strategy for the country. It had faced some challenges in 2020.

- Xiaomi’s shipments declined as it was hit the hardest by supply chain issues. But despite this, the brand captured the fourth position in the quarter.

- realme saw fast growth and was among the top five brands. To get ahead of chipset shortage issues, the OEM may be looking for opportunities and strategic partnerships, like the one it entered with UNISOC.

- The $150-$250 price band is advancing faster in the Indonesian market as users in the entry tier are upgrading fast.

In 2022, we will see tough competition for the top spot. The ASP (average selling price) for 5G smartphones will continue to see a slow decrease. Mid-tier smartphones are most likely to witness increased demand this year thanks to a continued focus on digital transformation and 5G network expansion. We are estimating a mid-single-digit growth rate in 2022.