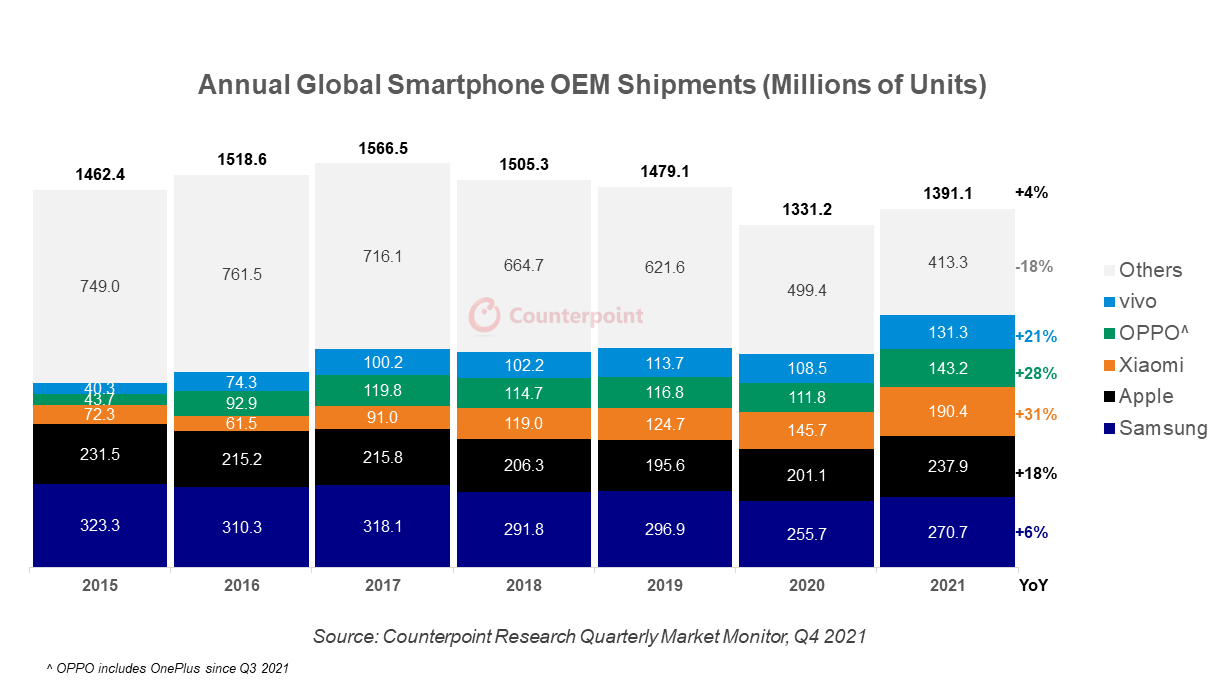

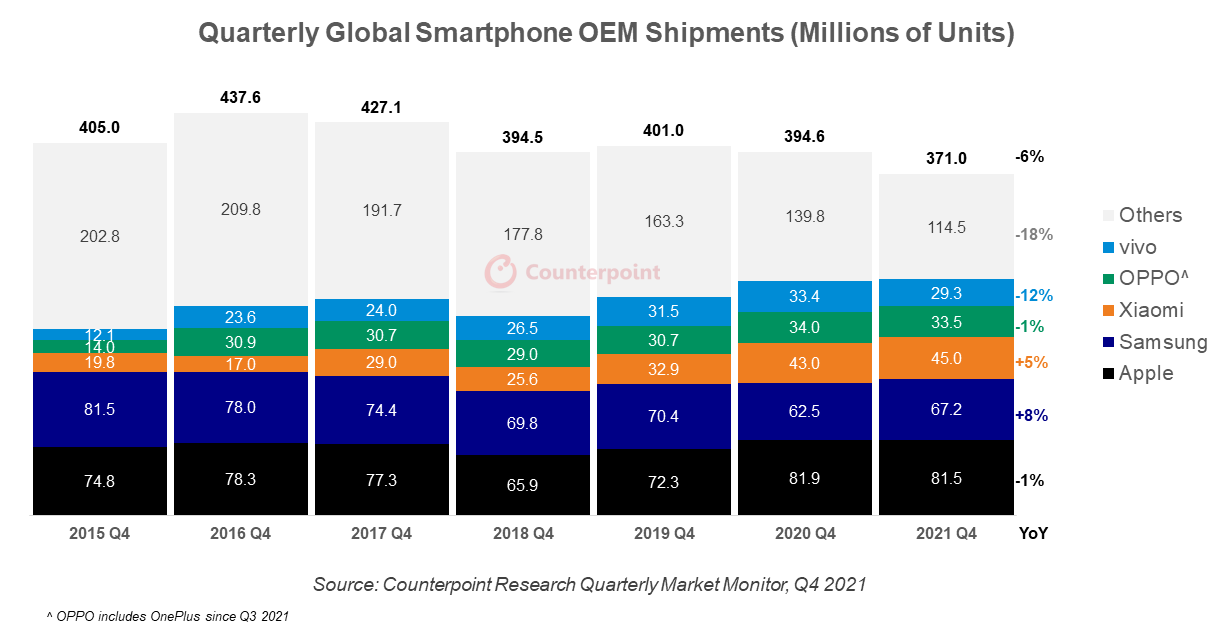

- Global smartphone shipments grew 4% YoY to reach 1.39 billion units in 2021. Q4 2021 shipments declined 6% YoY to reach 371 million units.

- Samsung led the global smartphone market in 2021 with annual shipments of 271 million units.

- Apple, Xiaomi, OPPO^ and vivo recorded their highest-ever annual shipments.

- The top five brands gained share thanks to a significant decline by Huawei, and LG’s exit from the market.

- Apple surpassed Samsung to become the top smartphone vendor in Q4 2021, shipping 81.5 million units.

The global smartphone market grew for the first time since 2017, with annual shipments reaching 1.39 billion units in 2021, according to the latest research from Counterpoint Research’s Market Monitor service. Despite the 4% annual growth, however, annual shipments remained below the pre-pandemic level due to continued COVID-19 impacts as well as component shortages.

Commenting on the overall market dynamics, Senior Analyst, Harmeet Singh Walia said “the global smartphone recovery in 2021 followed a pandemic-hit 2020 and subsequent pent-up demand in regions like North America, Latin America and India. Growth in the US was driven largely by demand for Apple’s first 5G-enabled iPhone 12 series seeping through to the first quarter of 2021; demand which continued throughout the year ending on a strong Q4 thanks to Black Friday and holiday season promotions. India, too, had a good year due to higher replacement rates, better availability and more attractive financing options in mid-to high-tier phones. However, China, the world’s biggest smartphone market, continued to decline due to supply-side issues caused by the ongoing component shortages, as well as demand-side issues resulting from lengthening replacement cycles.”

Singh Walia added, “the market recovery could have been even better if not for the component shortages that impacted much of the second half of 2021. The major brands navigated the component shortages comparatively better and hence managed to grow by gaining share from long-tail brands.”

- Samsung shipped 271 million units in 2021, up 6% from 2020, mainly due to increased demand for its mid-tier A and M series smartphones. Samsung’s annual shipments grew despite supply-side issues starting with its Vietnam factory being shut in June due to COVID-induced lockdown. While its shipments grew YoY to reach 67 million in the last quarter, the growth was limited by intensifying competition from Apple and Chinese brands in some of its markets such as India and Latin America. Nevertheless, the brand gained a good mind share with the launch of its third-generation foldable phones that did well in the premium segment.

- Apple’s global smartphone shipments grew 18% YoY to reach a record 237.9 million units in 2021 due to strong performance by the iPhone 12 series. Apple also grew in key markets such as the US, China, Europe and India. In China, it became the top smartphone brand in Q4 after six years thanks to the iPhone 13, consequently overtaking Samsung as the top smartphone globally in Q4 2021.

- Xiaomi’s global smartphone shipments grew 31% YoY to reach a record 190 million units in 2021. The bulk of this growth was in the first half of the year, driven by regions such as India, China, South-East Asia and Europe. While its shipments declined in Q3 after a record Q2, it grew marginally in Q4 to ship 45 million smartphones despite slipping to the fifth position in China as it faces severe component shortages.

- OPPO^ was another of the top smartphone players to achieve record 2021 shipments, growing by 28% YoY to 143.2 million units. Its performance in China remained strong in the first half of the year, while it grew in Europe, the Middle East and Africa and South-East Asia in the second half. However, shipments remained flat at 33.5 million units in the last quarter due to supply-side constraints.

- vivo grew by 21% YoY to reach annual shipments of 131.3 million units in 2021. vivo leveraged its strong offline penetration and a wide-ranging product portfolio to achieve its highest-ever annual shipments globally. In Q4 2021, however, it declined by 9% YoY, as it lost the number one spot in the Chinese smartphone market to Apple.

Other OEMs also had a notable 2021.

Motorola was the fastest-growing brand among the top 10 smartphone OEMs based on annual global shipments. It took advantage of LG’s exit in the US, where it gained share in the sub-$300 price band by offering a strong lineup of widely available devices. It also continued to perform strongly in Latin America while expanding in overseas markets (including a resurgence in Europe).

realme entered the top five android OEMs globally for the first time as its affordable 5G strategy started to pay off. It also did well in markets such as India where it had a record year. The brand continued to expand its presence in new markets such as LATAM, Europe and the Middle East and Africa.

HONOR managed to finish its first full year as an independent OEM with a ranking among the top ten smartphone OEMs globally, and is already among the top five OEMs in China where it benefitted from the reinstation of its relationship with its suppliers since its separation from Huawei.

Transsion Group continued to perform well in its key markets such as South Asia and the Middle East and Africa. TECNO did well in the entry-tier, while Infinix gained the most in the entry-to mid-tier segment, especially in the countries where it is currently expanding. Going forward, Transsion’s fundamentals are expected to remain solid, as it continues to hold significant clout in its home market of Africa.

Research Director Jan Stryjak concluded, “2021 was a tough year, with component shortages adding further pressure to a market battling with lingering COVID-19 issues. However, the world is slowly getting on top of the pandemic, despite the threat of a resurgence towards the end of last year, and with supply issues hopefully coming to an end towards the middle of this year, there is reason to be optimistic for good growth in 2022 as a whole.”

^Note: OPPO includes OnePlus since Q3 2021