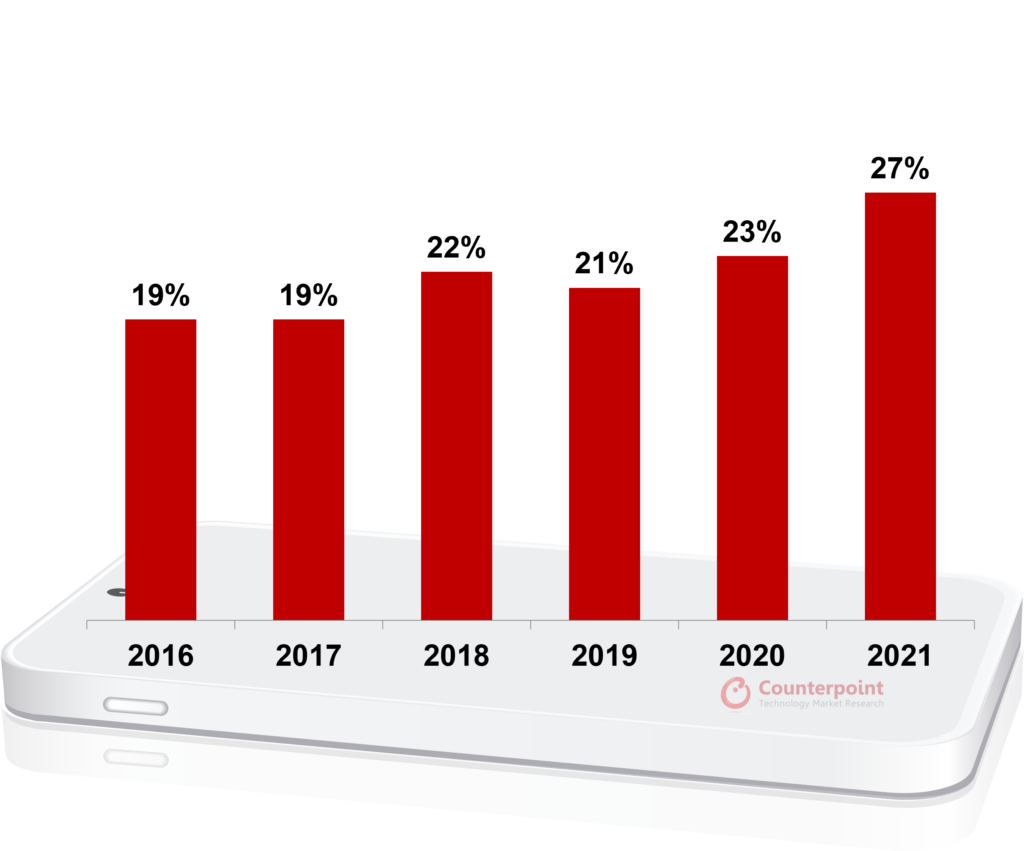

The global premium (>$400 wholesale ASP) smartphone market sales grew 24% YoY in 2021 to reach their highest ever level, according to Counterpoint Research’s Market Pulse Service. The growth in the premium segment outpaced the 7% YoY growth in the overall global smartphone sales in 2021. The premium segment alone contributed to 27% of the global smartphone sales, its highest ever share.

Global Premium (>$400) Smartphone Market Sales Contribution, 2016-2021

Source: Counterpoint’s Global Monthly Handset Model Sales (Sell-through) Tracker

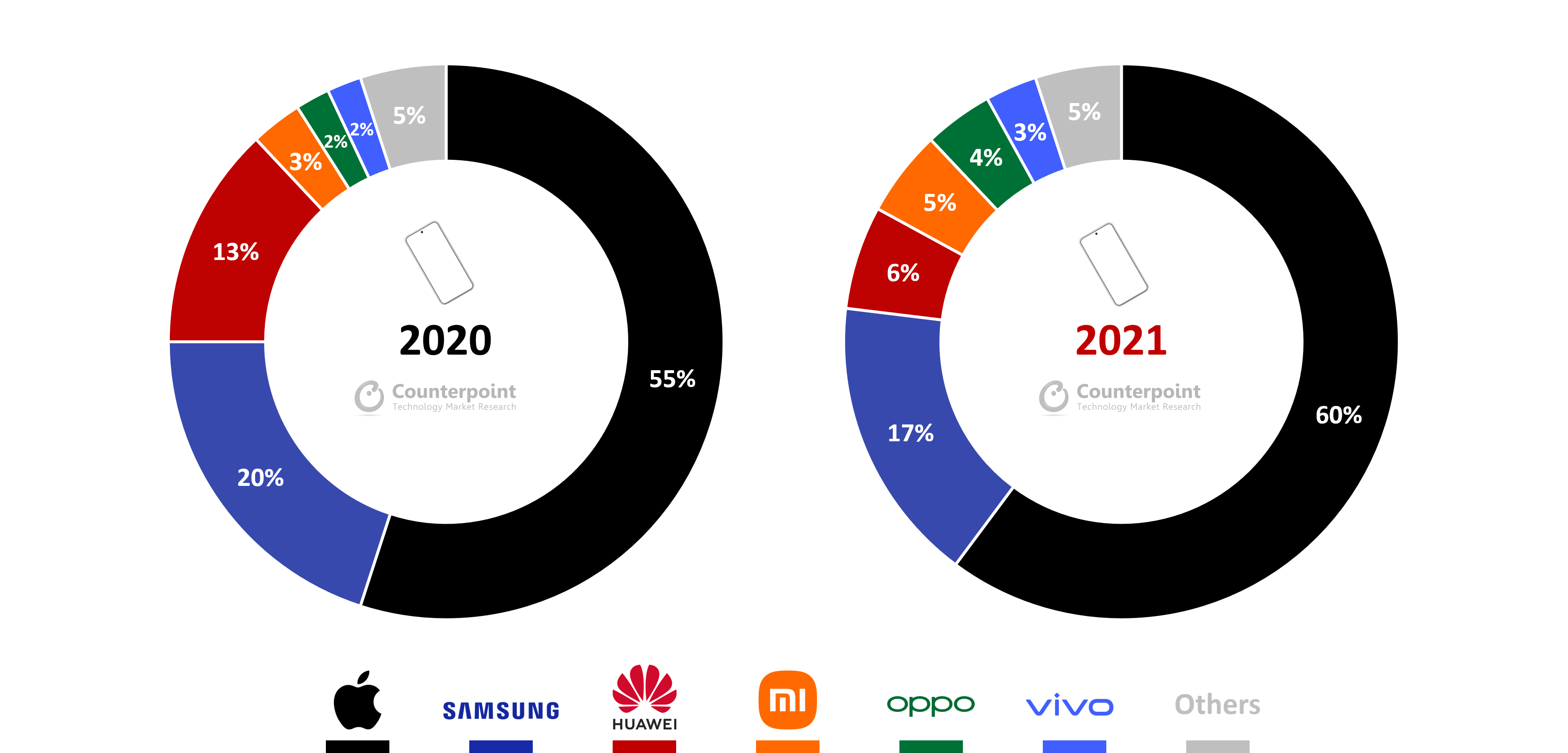

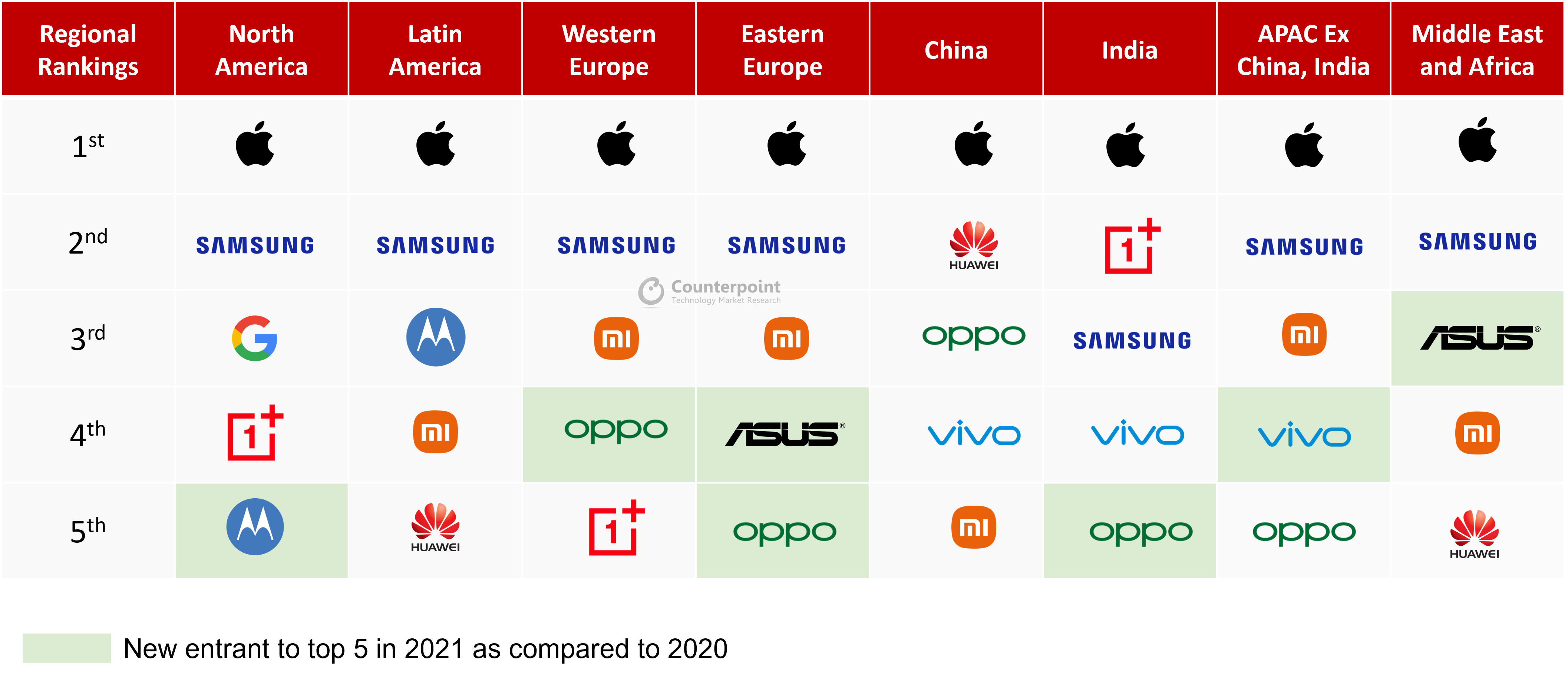

In terms of OEMs, Apple continued to lead the market, reaching the 60% sales share mark for the first time since 2017 driven by strong 5G upgrades for the iPhone 12 and iPhone 13 series. The delayed launch of Apple devices in 2020 also pushed demand to 2021. Apple, with its strong brand power, is in the best position to gain Huawei’s premium smartphone users. This is also indicated by Apple’s growth in China, where the brand reached its highest ever market share in Q4 2021. Apple was the top OEM in the premium segment in every region in 2021.

Global Premium (>$400) Smartphone Sales Share by OEM, 2020 vs 2021

Source: Counterpoint’s Global Monthly Handset Model Sales (Sell-through) Tracker

Samsung’s sales grew 6% YoY in the segment, but the OEM lost share. The S21 performed better than the pandemic-hit S20. The Galaxy Z Fold and the Flip series, which were launched in H2 2021, also performed well, especially in South Korea, North America and Western Europe. However, these gains were somewhat traded off due to the lack of a new Note series and an FE series refresh in 2021. Component shortages also affected the brand’s supply.

OPPO and vivo’s sales more than doubled in the premium segment in 2021, growing 116% and 103% respectively to help them make inroads into the top five premium brands in several regions. The rebranding of Reno in early 2021 helped OPPO capture the affordable-premium segment in China. OPPO has also been gaining steadily in the European market, aiming to fill the gap left by Huawei. vivo’s growth was driven by the X60 and X50 series in China and Southeast Asia.

Xiaomi’s gains were driven by the Mi 11 series. Xiaomi featured in the top-five list for the premium segment in almost all the regions where it operates. Asus also gained with its focus on the niche gaming segment. LG’s exit from the smartphone market helped Motorola, Google and OnePlus gain in the North American Market.

Global Smartphone OEM Rankings by Region, Premium (>$400) Segment, 2021

Source: Counterpoint’s Global Monthly Handset Model Sales (Sell-through) Tracker

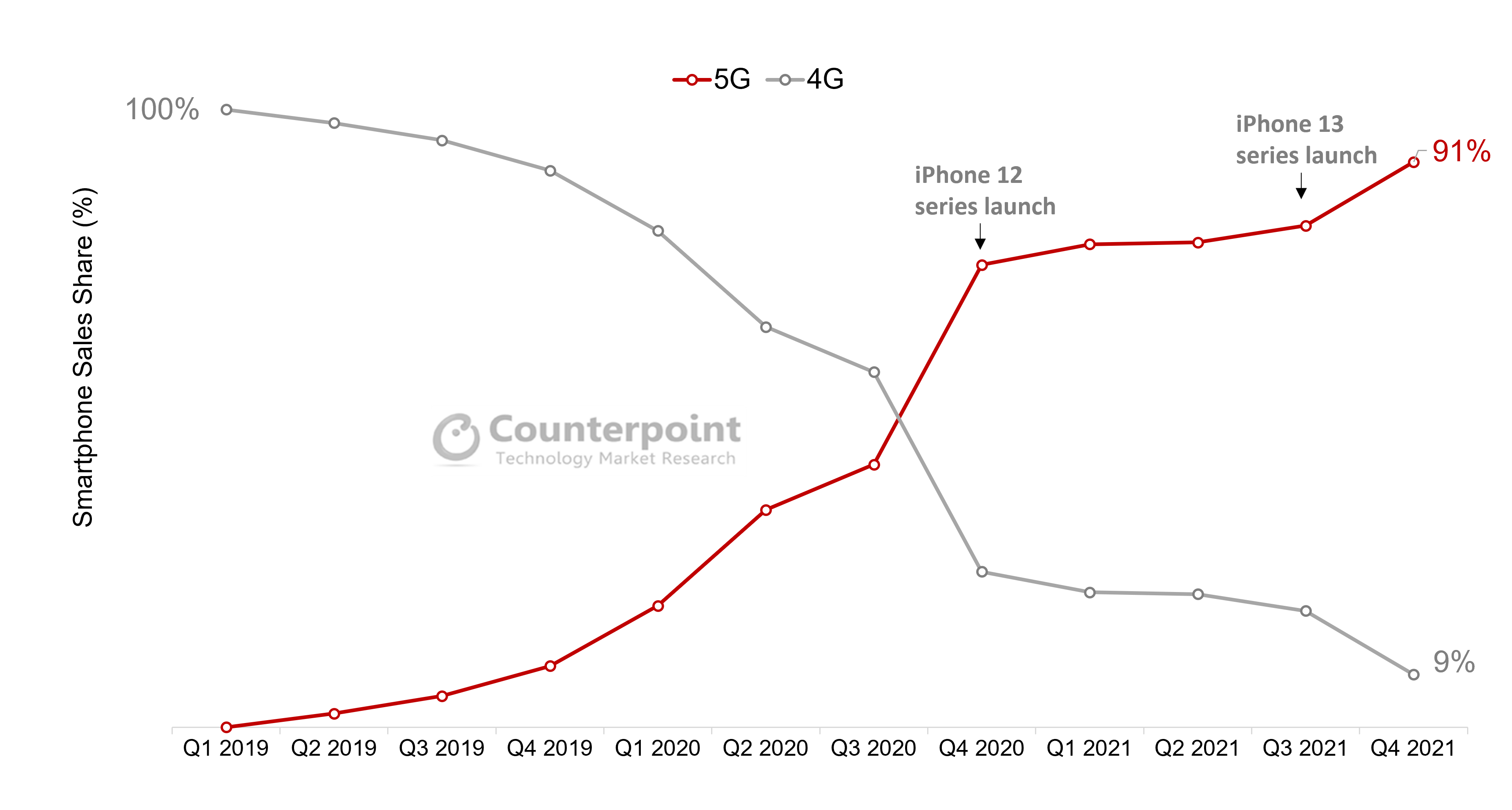

In terms of cellular access technology, 5G has become a standard offering across the premium segment. But 4G continues to have share driven by the older iPhones – 11 and SE 2020 – and the Samsung S20 FE. However, as these product lines also transition to 5G in 2022 and 5G also starts to make inroads into developing regions, the share of LTE will decrease further. But Huawei will continue to launch its new devices with LTE capability.

5G vs 4G Penetration in Premium (>$400) Segment

Source: Counterpoint’s Global Monthly Handset Model Sales (Sell-through) Tracker