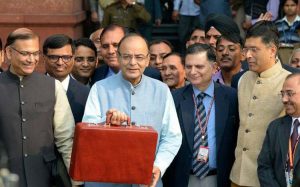

The Union Budget 2017-18, presented by the NDA government on 1st February, 2017, has put forth various initiatives to give a boost to the digital economy. The Budget has certainly offered some incentives as well as various tax and duty benefits to the electronic system design and manufacturing (ESDM) industry. But will these benefits strengthen the manufacturing capabilities of Indian companies? That remains to be seen.

The Union Budget 2017-18, presented by the NDA government on 1st February, 2017, has put forth various initiatives to give a boost to the digital economy. The Budget has certainly offered some incentives as well as various tax and duty benefits to the electronic system design and manufacturing (ESDM) industry. But will these benefits strengthen the manufacturing capabilities of Indian companies? That remains to be seen.

By Sudeshna Das

The thrust of Budget 2017-18 has been on promoting the digital economy post the demonetisation, in order to reduce corruption within the country. The Indian IT and electronics sector has undergone a transformation not only in terms of market size but also in hardware manufacturing capabilities, which have been boosted by government initiatives like Make in India.

Greater allocation of funds for MSIPS and the EDF in this year’s Union Budget will encourage local manufacturing in the Indian electronics hardware industry. Also, an increase in allocation for the defence budget will help to focus on the country’s strategic electronics ecosystem for greater self-reliance. The defence and aerospace sector in the country has seen considerable growth in recent years. The shift from India being a buyer to a manufacturer has to be made, and this step will further boost the domestic ecosystem.

However, a number of industry experts feel that this year’s Budget could have offered far more incentives to manufacturers of IT and electronics products. A few industry stalwarts also feel that some of the duty impositions, in fact, promote imports rather than Indian manufacturing.

Highlights of the Union Budget that are related to the ESDM industry

Incentive for ‘Make in India’

- Allocation of ₹ 7.45 billion for MSIPS and Electronics Development Fund to make India a ‘global electronics manufacturing hub’.

- Defence budget increased by about 5.8 per cent to ₹ 2.74 trillion with provisions for strategic electronics.

Key tax reforms for components, products, etc

Populated PCBs for mobile phones: Populated PCBs of mobile phones are being excluded from the purview of nil SAD under Serial No. 1 of Notification No. 21/2012-Customs (which exempts SAD on items that are exempt from BCD and CVD), dated March 17, 2012 as amended vide Notification No. 4/2017 – Customs, dated February 2, 2017 (new Serial No. 85B). Simultaneously, 2 per cent concessional SAD is being prescribed on populated PCBs for use in the manufacture of mobile phones, subject to actual user condition. The concessional SAD will be valid till June 30, 2017.

Micro ATMs, fingerprint readers/scanners and iris scanners: Basic customs duty (BCD), CVD (by way of excise duty exemption) and, consequently, SAD are being exempted on micro ATMs (as per standards version 1.5.1), fingerprint readers/scanners, and iris scanners. The same are also being exempted on parts and components for the manufacture of these devices, subject to actual user condition. Refer to Notification No. 12/2012-Customs, dated March 17, 2012 as amended vide Notification No.6/2017- Customs, dated February 2, 2017 (new Serial No. 408A).

Miniaturised POS card readers for mPOS: Basic customs duty (BCD), CVD (by way of excise duty exemption) and, consequently, SAD are being exempted on miniaturised POS card readers for mobile point of sale or mPOS (other than mobile phones or tablet computers). These are also being exempted on parts and components for the manufacture of miniaturised POS card readers for mPOS (other than mobile phones or tablet computers), subject to actual user condition. Refer to Notification No. 12/2012-Customs, dated March 17, 2012 as amended vide Notification No.6/2017- Customs, dated February 2, 2017 (new Serial No. 408A).

Reverse osmosis (RO) membranes used in electronic water treatment units: Basic customs duty on reverse osmosis (RO) membrane elements for household water filters falling under Tariff item 8421 99 00 is being increased from 7.5 per cent to 10 per cent – refer to Clause 109 (a) of Finance Bill, 2017.

CNC systems: Concessional basic customs duty of 2.5 per cent is being extended to ball screws [8483 40 00], linear motion guides [8466 93 90] and CNC systems [8537 10 00] for use in the manufacture of all types of CNC machine tools falling under headings 8456 to 8463, subject to actual user condition.

LED lights or fixtures including LED lamps:

- Five per cent concessional basic customs duty (BCD) is being prescribed on all parts for use in the manufacture of LED lights or fixtures including LED lamps, subject to actual user condition. Refer to Notification No. 12/2012-Customs, dated March 17, 2012 as amended vide Notification No. 6/2017- Customs, dated February 2, 2017 (new Serial No. 410 A).

- Five per cent concessional BCD is also being prescribed on imports used in the manufacture of LED drivers or MCPCB (metal core printed circuit boards) for LED lights and fixtures or LED lamps, subject to actual user condition. Refer to Notification No. 12/2012-Customs, dated March 17, 2012 as amended vide Notification No. 6/2017- Customs, dated February 2, 2017 (new Serial No. 410 B).

Solar cells:

- Basic customs duty (BCD) is being reduced from 10 per cent/7.5 per cent to 5 per cent on all items of machinery, including instruments, apparatus and appliances, transmission equipment and auxiliary equipment (including those required for testing and quality control), and the components required for initial setting up of fuel cell based systems to generate power or for demonstration purposes, subject to certain conditions. Refer to Notification No.5/2017-Customs dated February 2, 2017.

- BCD has been reduced to nil on solar tempered glass used in the manufacture of solar cells, panels and modules. CVD has been reduced to 6 per cent from 12.5 per cent on the parts of solar tempered glass.

Ease of doing business and good governance

- Over 90 per cent of FDI proposals will now be processed through the automatic route.

- E-filing and online FDI processing have been introduced to ease investments.

- FIPB (Foreign Investment Promotion Board) has been abolished to encourage foreign investments.

- There is a proposal to reduce corporate tax for companies with an annual turnover of up to₹ 500 million to 25 per cent.

- CBEC (Central Board of Excise and Customs) will continue to strive to implement GST.

- No change in excise and service tax rates due to upcoming GST.

- Tax relief to startups for seven years.

The overall tax reliefs given to startups and

MSMEs will boost sustainable employment and the quality of startups in the design led manufacturing sector.

Encouraging Digital India

- A mission will be set up with a target of 25 billion digital transactions for 2017-18 through UPI, USSD, Aadhaar Pay, IMPS and debit cards.

- Aadhaar-based payment system to help people not having debit/credit cards.

- Allocation of ₹ 100 billion for BharatNet project to provide high-speed broadband in FY18.

- Under the BharatNet project, OFC (optical fibre cable) has been laid across 155,000 km.

- By the end of 2017-18, high speed broadband connectivity on optical fibre will be available in more than 150,000 gram panchayats, with Wi-Fi hot spots and access to digital services at low tariffs.

- A DigiGaon initiative will be launched to provide tele-medicine, education and skills through digital technology.

- Banks to introduce additional 1 million POS devices by March 2017 and 2 million Aadhaar based swipe machines by 2020.

Enabling ‘Skill India’

- SANKALP Programme for skill development has been allocated ₹ 40 billion.

- There is a proposal to leverage ICT with the launch of the Swayam platform which has 350 free courses.

- Innovation fund for secondary education to be set up.

- PM’s Kaushal Kendras will be extended to 600 districts; 100 international skill centres to be opened to help people get jobs abroad.

Industry leaders’ Views

“We are happy that the budget has laid primary emphasis on the digital economy across development areas highlighted by the finance minister. Digital economy is now the key enabler for important development initiatives including cashless transactions, and the government is focusing on last mile connectivity and network penetration across India to further bolster the idea of Digital India.

“We are happy that the budget has laid primary emphasis on the digital economy across development areas highlighted by the finance minister. Digital economy is now the key enabler for important development initiatives including cashless transactions, and the government is focusing on last mile connectivity and network penetration across India to further bolster the idea of Digital India.

Debjani Ghosh, MD, South Asia, Intel and president, MAIT

“The proposal to make India a global electronics manufacturing hub will boost the domestic electronics ecosystem. This, in turn, will lead to the setting up of electronics clusters across various towns and cities. The huge investments in manufacturing will bring about more capacity creation within the country, simultaneously deterring to some extent the blind import of products. Allocations, incentives and schemes like MSIPS and EDF amounting to ₹ 7.45 billion reflect the government’s strong commitment to promote local value addition in electronics manufacturing.

“The proposal to make India a global electronics manufacturing hub will boost the domestic electronics ecosystem. This, in turn, will lead to the setting up of electronics clusters across various towns and cities. The huge investments in manufacturing will bring about more capacity creation within the country, simultaneously deterring to some extent the blind import of products. Allocations, incentives and schemes like MSIPS and EDF amounting to ₹ 7.45 billion reflect the government’s strong commitment to promote local value addition in electronics manufacturing.

M.N. Vidyashankar, president, IESA

“ Domestic value added manufacturing is not supported by the budget and this will encourage imports, especially of POS machines, micro ATMs and scanners to promote a cashless economy, as all duties including BCD, CVD and SAD have been waived. The industry had recommended differential duty or the imposition of BCD on the finished products to give an immediate boost to their assembly. Waiver of all duties will result in a flood of imports without enabling the creation of a local industry and a big opportunity for manufacturing these products in the country would be lost.

Domestic value added manufacturing is not supported by the budget and this will encourage imports, especially of POS machines, micro ATMs and scanners to promote a cashless economy, as all duties including BCD, CVD and SAD have been waived. The industry had recommended differential duty or the imposition of BCD on the finished products to give an immediate boost to their assembly. Waiver of all duties will result in a flood of imports without enabling the creation of a local industry and a big opportunity for manufacturing these products in the country would be lost.

B.S. Sethia, past president, ELCINA and co-chairman Policy Committee, ELCINA and MD, Elin Electronics

“We did not see anything very specific regarding Make in India in this budget and there were two comments by the finance minister on the MSIPS and the EDF (Electronics Development Fund). He said that an all-time high amount of ₹ 7.45 billion has been allocated for this. It is not clear as to what specific period the amount has been allocated for, since the overall limit for the MSIPS was ₹ 100 billion and the scheme was supposed to come to an end in December 2018. Therefore, it is not clear what was the basis for this amount. Moreover, it seems to be very low, especially if it is for the whole year of 2017-18. I am sure the requirement for MSIPS and its related investments will be higher.

“We did not see anything very specific regarding Make in India in this budget and there were two comments by the finance minister on the MSIPS and the EDF (Electronics Development Fund). He said that an all-time high amount of ₹ 7.45 billion has been allocated for this. It is not clear as to what specific period the amount has been allocated for, since the overall limit for the MSIPS was ₹ 100 billion and the scheme was supposed to come to an end in December 2018. Therefore, it is not clear what was the basis for this amount. Moreover, it seems to be very low, especially if it is for the whole year of 2017-18. I am sure the requirement for MSIPS and its related investments will be higher.

In case of LED lights, fixtures and LED drivers and its parts, BCD has been prescribed at 5 per cent and CVD/excise at 6 per cent. Almost all mechanical and electro-mechanical parts, as well as LED drivers, for LED lights are manufactured in India in good numbers and were subject to 10 per cent BCD. Reduction of BCD to 5 per cent on these items would result in the import of these parts increasing.

Further, inputs for LED drivers have been brought under 5 per cent BCD though presently these are at zero BCD, as all are ITA-bound. While this could help in enhancing local sourcing of components such as capacitors, resistors, PCBs and connectors, imports are likely to happen without actual user condition to avoid the 5 per cent BCD. The objective of greater local value addition and local sourcing of inputs for drivers would thus be obviated.

Rajoo Goel, secretary general, ELCINA

“The concessional excise and customs duty benefits have not been extended to all ITA goods to make manufacturing far more sustainable in India. The extension of the duty differential scheme to the PC segment would have definitely taken India one step closer to making it an export hub and achieving the vision of Digital India, as PCs are used to achieve economic growth as opposed to mobiles which are consumption devices.

“The concessional excise and customs duty benefits have not been extended to all ITA goods to make manufacturing far more sustainable in India. The extension of the duty differential scheme to the PC segment would have definitely taken India one step closer to making it an export hub and achieving the vision of Digital India, as PCs are used to achieve economic growth as opposed to mobiles which are consumption devices.

Nitin Kunkolienker, VP, MAIT and director, corporate affairs, Smartlink Network Systems