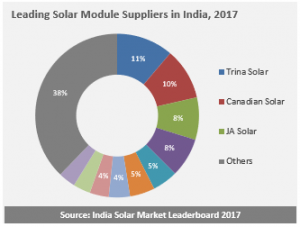

According to module shipment data for 2017, Trina Solar was the single largest supplier of modules to India in 2017. The newly released report by Mercom India Research India Solar Market Leaderboard 2018 covers market share and shipment rankings across the Indian solar supply chain in 2017.

The top 5 module suppliers made up over 45 percent of market share in 2017. Canadian Solar was the second largest module supplier to India followed by JA solar in 2017. The same three companies were also the top three suppliers to India in the same order in terms of cumulative installations.

Cumulatively, top 10 companies have supplied over 1 GW of solar modules to the Indian market.

A lot of the module supply dynamics could change based on how the safeguard duty case plays out. There is also a good chance that many international companies could open manufacturing facilities in India especially if the SECI tender for 5 GW manufacturing capacity becomes a reality.

NEXTracker was the top tracker supplier to the Indian solar sector in terms of cumulative shipments at the end of 2017, followed by Arctec Solar. As of 2017, there were over 30 tracker suppliers to the Indian solar market. NEXTracker has over 1 GW in tracker sales to India. Top 3 tracker suppliers account for almost 70 percent of the market share in India.

In India, most solar large-scale projects do not have trackers. Cost plays a big part in using trackers along with topology in India. With most major Indian solar states enacting deviation charges for over or under production, trackers are not on the priority list of many developers in India.

Raj Prabhu, CEO of Mercom Capital Group said that as the demand in China decreases, international companies are looking more and more towards India as one of the most important markets to expand into. He further stated that an India market entry/expansion strategy has become a must for international companies if they are not already supplying to the country.

(Source: Mercom India)