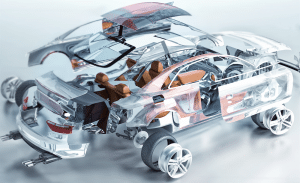

As electric mobility picks up pace and the automotive industry – automakers and component suppliers – gears up to meet the green mobility challenge, the new phase of motoring is also throwing up new business opportunities across sectors.

One such sector which stands to gain from electro-mobility is the tooling industry, which caters to the automotive, aerospace, plastic, electrical, packaging, electronics and general engineering industries. It had an estimated market size of around Rs 14,650 crore in FY2016-17 with domestic manufactured tools estimated at Rs 11,950 crore and has been steadily growing through adoption of technology and new solutions. The automobile industry is one of the significant contributors to the tooling industry.

Last month, on February 1-2, the Tool and Gauge Manufacturing Association India (TAGMA), the apex body of the Indian tooling industry, held its third International Tooling Summit in Chennai. The summit saw a panel discussion on the ‘Impact of EV on Tooling Industry’ moderated by Sumantra B Barooah, executive editor, Autocar Professional. The participants were Karthik A, general manager, EV & e-mobility solutions, Ashok Leyland; Ashim Sharma, partner & group head, Nomura Research and Debi Prasad Dash, director, Indian Energy Storage Alliance, who discussed the road ahead for the tooling industry, the challenges and opportunities in the changing mobility scenarios.

In his opening remarks, Karthik A said, “Electric mobility is going to change things in the near future and the impact on tooling industry is likely to be in terms of skills.”

“Electric mobility in terms of vehicles on the road is still 3-4 years away with the battery and charging technology catching up. Till such time, a lot of work needs to done by OEMs and suppliers. Although it is going to be an exciting time with a definite shift in the volume of vehicles, by 2024-25 our (Ashok Leyland) mainline products will be churning out anywhere close to 50 percent as electric powertrain vehicles” he said.

Impact of tooling on EV industry

Ashim Sharma of Nomura Research highlighted the impact that tooling industry likely to have in the electric mobility world. He said, “Moving parts in electric vehicles are far lesser than those in conventional vehicles, which will impact some of the toolings used in making these moving parts. Similarly, toolings used in making engine will also be eliminated. At the same time, there will be few opportunities like casing for the batteries or motors. Lightweight is going to be important to enable higher range for an EV, though this will call for some new skills. Given that the OEMs have to deal with new technology areas to take care of, they may have higher propensity to outsource some of the more conventional areas like the tool design.”

According to Debi Prasad Dash of India Energy Storage Alliance, “EV penetration would certainly go up in next few years but the 60-70 percent cost of the vehicle is battery where a lot of research is underway.”

He added, “EVs will need few new components both for vehicles and batteries. If we want fully indigenous EVs, then Indian companies will have to enter in this area to make these new components locally, these offer opportunities to suppliers.”

“Similarly, for charging or swapping stations, we need various components which are currently being imported. Here is a huge opportunity for local tool and component makers to design and manufacture in India. Local component suppliers currently engaged in supplying component to the auto industry have an opportunity to diversify to manufacture components for EVs,” elaborated Dash.

Speaking on the CV OEMs’ approach towards EVs, Karthik said, “The leading OEMs have focused on generating the powertrain and energy management parts. Typically, they will take an existing platform and bring in electric drivetrain and battery to come up with various strategies to manage the energy, first try to understand and internalise it; lightweighting is the next step. EV technologies are changing rapidly, which calls for more accurate tooling to keep pace with vehicle powertrain requirements.”

Speaking on the tooling industry’s delivery and speed of providing solutions, Nomura Research’s Sharma said, “Like mobile phones, there is the possibility of influx of Chinese EV products in India; this means a shorter lifecycle and shorter time to market which puts a lot of pressure on the OEMs and hence on tool makers. This calls for tooling providers to become faster, agile and deliver rapid solutions.”

According to Sharma, “To address some of the challenges of tooling industry, there is a growing need for tie-ups with local and foreign tool rooms as well as small and big players. This will help them respond quickly to market needs. Some of them have taken technological leaps, especially in new materials. This is the way forward.” He cited an example from the automobile industry – with the entry of Maruti Suzuki, many Japanese suppliers formed JVs with Indian companies to make key products for Maruti cars which have become synonymous with quality, reliability and a superior manufacturing base.

Speaking on the clear policy scenario for electric vehicles in India, Debi Prasad Dash said, “There are several government agencies which are currently engaged in the EV policy framework. However, NITI Aayog has taken a lead coordinating with various government departments and working towards this direction with clear objectives, getting in place battery technologies and charging infrastructure.”

The advent of electric mobility is clearly presenting more than a few opportunities for the tooling industry. However, this major shift also brings some challenges. The panelists, therefore, agreed that the tooling industry needs to re-skill, invest in future technologies, and at the same time make considerable progress in obtaining knowledge in process engineering and die engineering which is going to be critical for long-term sustainable growth of the industry.