The demand for chemicals and materials used in the Indian electronics industry does not follow global market trends. Let’s have a look at what is driving local demand, and how this is being met.

The demand for chemicals and materials used in the Indian electronics industry does not follow global market trends. Let’s have a look at what is driving local demand, and how this is being met.

By the ComConnect Consulting research team

A broad range of highly sophisticated chemicals and materials—solid, liquid and gaseous—is used at different stages of electronic component and product manufacturing, starting from the fabrication of semiconductors and printed circuit boards (PCBs) to the production of flat panel display units, the various stages of cleaning, chip packaging, and product insulation. It follows that the demand for these chemicals and materials will increase owing to the growth in electronics manufacturing.

This report highlights the key demand-side and supply-side drivers, as well as the challenges faced by companies in this sector.

Opportunities galore

The increase in demand for electronic chemicals is related to the overall growth in the production of electronic devices, as well as innovations in technology. According to BCC Research, a firm headquartered at Massachusetts, USA, the global market for electronic chemicals is expected to reach US$ 30.5 billion by 2020, with a CAGR of 5.9 per cent from 2016 to 2020. The wafer fabrication segment had the highest (revenue) share in 2016 and is expected to maintain its lead throughout this period. Silicon wafers are the most common type of wafer fabrication material used globally.

The same report states that the global demand for electronic chemicals and materials has increased owing to tech advancements and the increase in demand from applications like photovoltaics, integrated circuits, as well as PCBs for mobiles, laptops, computers, tablets, LED bulbs, etc. Other factors driving market growth in the world include strict environmental regulations, increasing consumption of IC process chemicals, and rapid economic growth in emerging countries. The Indian market may be a significant contributor in this growth story, considering the resurgence of the Indian electronics manufacturing industry.

Methodology

The research team at ComConnect Consulting adopted a methodology to collate quantitative and qualitative information on the market for electronic chemicals, which used secondary research. The findings were then analysed and verified by industry members, either through exclusive interviews or in response to the survey questionnaire. We interacted with stakeholders across global and Indian companies. This sample group is a microcosmic representation of the electronic chemicals and materials industry ecosystem, comprising suppliers of chemicals and materials for the electronics industry and users like component or PCB manufacturers (Figure 1). These senior professionals shared their insights on the following aspects:

- Approximate rate for year-on-year growth

- Market opportunities

- Demand-supply gap

- Types of products in demand

- Primary source of products (local production or imports)

- Market challenges

A trend analysis was done on the basis of their inputs. The results of the analysis are presented here.

Sixty per cent of the survey participants forecast that the Indian market for chemicals and materials used in electronics manufacturing will grow at a rate of up to 20 per cent. However, 20 per cent of the survey participants predict a growth rate between 20-30 per cent. The remaining 20 per cent expect an even more accelerated growth of over 30 per cent.

Market segments

The materials used in electronics manufacturing are well known high-purity chemicals such as photoresists, wet chemicals, acids, gases and solvents, as well as wafers and laminates.

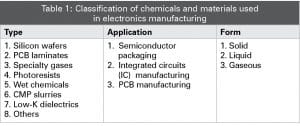

Based on the types of products, the market can be divided into eight segments—silicon wafers, PCB laminates, photoresists, specialty gases, CMP slurries, wet chemicals, Low-K dielectrics, and others (Table 1).

Market demand

As stated earlier, silicon wafers constitute the major chunk of the global market for electronic chemicals and materials, and are widely used as base materials in the manufacture of semiconductors. PCB laminates are widely used for manufacturing PCBs. Low-K dielectrics are relatively recent applications of semiconductors and ICs and, therefore, are expected to grow aggressively in the next five years across the globe.

The Indian market for electronic chemicals and materials does not follow global trends. This market is expected to be primarily driven by the demand for wet chemicals and PCB laminates. Environmentally safe products will also be in demand. Survey participants unanimously predict a huge demand for wet chemicals. According to them, future growth will predominantly come from the following top three demand generating categories (Figure 3):

- Wet chemicals

- PCB laminates

- Silicone chemicals

Moreover, there is a demand for plain PET and PP films, liquid and powder epoxy, TPCS and TCA wire.

Demand-supply gap

The Indian market for electronic chemicals and materials has been growing primarily through higher imports as the local production is insignificant. Seventy per cent of survey participants stated there is a demand-supply gap on account of inadequate local production (Figure 4). The value addition through local manufacturers is quite limited, as most high-value and critical categories of materials are still imported.

Seventy per cent of the survey participants mentioned that imports are the main source of the electronic chemicals and materials used in India. However, 20 per cent of the participants in the survey said local production is adequate to meet demand, while 10 per cent of the participants said that demand is met by both local production and imports (Figure 5).

The local production ecosystem for electronic chemicals and materials is still not mature enough. Therefore, currently, local sourcing is primarily limited to:

- Adhesives

- Basic level PCB cleaning and coating solutions

- Solder pastes

Silicone chemicals are imported in bulk. Advanced conformal coatings are also imported and not manufactured locally. According to survey participants, there is a huge gap between demand and local supply in this category, and cost-effectiveness plays a big role in the market. Chinese and Korean products have captured the major market share. PCB chemicals and fluxes are also imported, as no manufacturing is done in the country.

The Indian market is characterised by the presence of several well-established global, regional and local suppliers. The competition in the market is expected to intensify due to the expansion of product portfolios and tech advances. Considering the growing importance of this market, a few global players have already set up production units in India. This is expected to bridge the demand-supply gap in this sector to a certain extent. Given that there is a huge domestic demand for electronic components and products, development of the electronic chemicals and materials industry will also help the entire electronics manufacturing ecosystem to achieve long-term sustainable growth in line with the Make in India initiative. To develop a strong components industry, we first need to have a local ecosystem for raw materials.

Market challenges

- Miniaturisation of electronic components and products has resulted in less use of chemicals

- Cost sensitivity of the markets

- Limited availability of high quality products

- Limited scale of electronics manufacturing in the country

- High import costs

- Unfavourable tax and duty structures

- Lack of quality logistics support or services, resulting in poor handling and wastage

- Inefficient supply chain

Major contributors for this report

- Ajay Durrani, MD, Covestro

- Chetan Uchil, partner, Aalpha Conformal Coating

- Anil Bali, VP, Deki Electronics

- Biju Thomas, proprietor, Superior Flux & Mfg Co.

- Madhusudan M., director, SCH Coating Solutions Pvt Ltd

- Biju Philip, managing partner, EMT India

- P. Gujral, director, Drive Technology

- Rushabh Solani, director, Prime Electrochem

- Rajaram M.P., regional sales manager, Henkel Adhesive Technologies

- Emmanuel David, manager, R&D, Speedofer Components