NEPCON Japan has traditionally been the showcase for the hot, new trends in electronics. This year, too, the event lived up to its top billing, giving visitors a glimpse into what will dominate the industry in the coming months – in the EV space, in wearables, and in smart manufacturing.

By Rahul Chopra

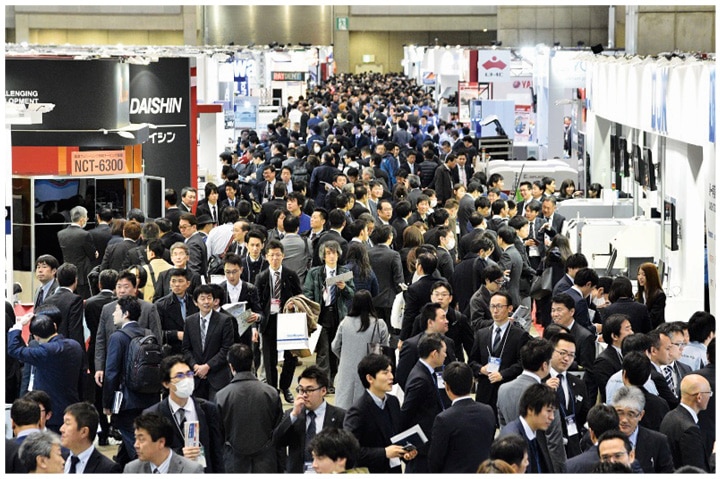

I was lucky enough to be there at NEPCON Japan, and attend various co-located events, including its hottest show—Wearable Electronics Expo 2018. With 2,500-plus exhibitors, it was impossible to even pass through all their booths, so I focused on sectors where a lot of innovation and new technologies were being announced. Here are some of the key trends that I would like to share with you.

I was lucky enough to be there at NEPCON Japan, and attend various co-located events, including its hottest show—Wearable Electronics Expo 2018. With 2,500-plus exhibitors, it was impossible to even pass through all their booths, so I focused on sectors where a lot of innovation and new technologies were being announced. Here are some of the key trends that I would like to share with you.

Wearable electronics

This is a very HOT sector and it spans a very wide range of players in sectors ranging from chemicals, materials and components to chips, modules, devices and service providers.

Within wearables, ‘glasses’ is a category that’s gaining momentum. Multiple players are ready with their solutions—some have already launched their glasses, while others are about to introduce them in 2018. Could 2018 be the ‘tipping point’ for this product category? That’s a billion dollar question.

These glasses are still very expensive though—starting from US$ 1,000 and with only the sky as the upper limit.

While Google and Microsoft are already the champions in this category, and are developing platforms based on which others can provide solutions to their customers, Japanese brands seem to be developing their own glasses along with software stacks for specific customers—thus controlling their go-to-market destiny. They are also open to connecting with distributors and systems integrators who can use their technology to develop or resell solutions in other nations.

While Google and Microsoft are already the champions in this category, and are developing platforms based on which others can provide solutions to their customers, Japanese brands seem to be developing their own glasses along with software stacks for specific customers—thus controlling their go-to-market destiny. They are also open to connecting with distributors and systems integrators who can use their technology to develop or resell solutions in other nations.

Westunitis demonstrated two different offerings—Infolinker, which is a fully powered computer inside a pair of wearable glasses that can do all the data crunching by itself. The other solution is PicoLinker, which offers essentially ‘only display’ wearable glasses, where data is streamed via Bluetooth from any mobile device.

BLINCAM demonstrated a cute wearable camera that attaches to your spectacles or sun glasses and allows you to take pictures by blinking your eyes (in a particular fashion). So you can experience a great dance performance, for instance, without disturbing your view with your camera or mobile phone while clicking photographs, and the claps of appreciation can be louder too.

Boston Club—a leading Japanese eye-wear OEM and ODM, showcased its ‘neoplug’ np-001 model. This is essentially a smart attachment and detachment slide system to help you put your wearable on your glasses. The Boston Club team explained that neoplug offers a great platform for both optical frame manufacturers and wearable device developers to grow their respective markets without one having to worry about the other.

JMACS demonstrated four different models of smart glasses under its nvEye series. The company’s claim to fame is that its solution is designed to help senior employees supervise the work of remote workers in real-time, see the exact challenge faced by the worker and give precise instructions to solve it. It can also be used for remote training. The glasses are to be worn by the remote worker while the supervisor can see everything on any computing device across the globe.

JMACS demonstrated four different models of smart glasses under its nvEye series. The company’s claim to fame is that its solution is designed to help senior employees supervise the work of remote workers in real-time, see the exact challenge faced by the worker and give precise instructions to solve it. It can also be used for remote training. The glasses are to be worn by the remote worker while the supervisor can see everything on any computing device across the globe.

Other innovative solutions demonstrated for business users were wearable RFID and barcode scanners by Welcat, a touchless floating signage system by JMACS, and bone conduction earphones by BOCO that enable you to listen to instructions from colleagues and even speak while keeping your ears free to hear.

While Fitbit demonstrated its popular range of fitness bands and watches, it saw competition from players like Nanovivo (another US firm), which claimed that its WellSign is the world’s first wearable that can monitor your fat on a molecular level using a non-invasive photonic sensor!

Prototypes of a new type of rubber were demonstrated by Toyoda Gosei (a Toyota Group company). Called e-Rubber, this material expands or contracts with the passage of current, and is expected to become an important material for artificial muscle. As e-Rubber has also become an excellent tactile sensor, it is being engineered for use in robots – for when contact between the robot and what it handles needs a soft touch.

For consumers, the typical investment right now involves both capex (buying the device) and opex (paying for the service), but as the wearables industry matures and more investments pour in, we expect to see more ‘pay as you go’ solutions providers.

Automotive electronics

From the powertrain and dashboard to infotainment, safety, connectivity and managing all aspects of an EV – the role of electronics is expanding rapidly in the automotive industry. Your mobile phone could soon be the key of your car and help you manage a lot of the functions of your vehicle. It will not only open doors, but turn on the ignition and tell your car the exact settings that you prefer for its interiors (like the position of the steering wheel and the seat). Reflection mirrors may soon be replaced by cameras and screens, which you can monitor on your instrument cluster (dashboard). Some images might also be projected on your windscreen. The car will monitor your vital signs thanks to specialised image sensors, and will warn you if these detect any abnormalities that might affect your driving. I suspect that, soon, cars may refuse to move if they detect you are drunk!

Automatic defrosting is being enabled by accurate temperature sensing of the vehicles’ windshield and by controlling the air conditioner—enabling better fuel efficiency too—a must for EVs. Certain chips have been introduced that make vehicles more reliable despite the increasing level of electronics in them. For example, ROHM has introduced a new chipset (which it claims is the world’s first such model) that ensures that even if the GPU of the instrument panel or dashboard malfunctions, the panel will continue to display critical information (like speed, fuel levels, etc).

EVs have more in-cabin noise—as they themselves are very silent—hence DSPs (digital signal processors) from firms like ROHM and Asahi KASEI are being introduced to improve communication between passengers and to cancel this noise. Similar DSPs are improving voice recognition capabilities and enabling better hands-free communication too. EVs are also pushing more power components into a smaller area, hence making heat tolerance an important attribute of components. There were demos of quite a few components that can handle a wider range of operating conditions including temperature, humidity, etc. Murata, for example, demonstrated its new high temperature film capacitor (FH series) that the firm claims can handle operations up to 125°C as compared to conventional variants that can operate only till 105°C!

Did you know that BlackBerry (the same mobile handset firm) has a subsidiary called BlackBerry QNX? It seems that QNX has managed to survive and thrive, while its parent has witnessed many ups and downs. QNX used a Jaguar (Tata, India) to showcase its entire range of automotive solutions, which consist of the operating system, development tools and embedded systems engineering services. Specific solutions showcased included acoustics management, an instrument cluster platform and an ADAS (advanced driver assist system) platform.

Manufacturing equipment

At NEPCON, faster machines for electronics manufacturing were introduced by Yamaha, Fuji and Panasonic. M2M communication and the smart factory is a trend that’s catching on where players like Fuji are working with other equipment brands (like Omron) to ensure that their equipment can speak to each other and make the overall manufacturing line smarter.

Yamaha claimed that it now has the fastest chip-shooters for single beam, double beam and four beam configurations. Fuji is pitching the idea of a dark production floor—where negligible human presence will be required. Instead, people can sit in their offices and manage the entire production cycle from their PCs. Robots that take components from warehouses and load them onto SMT machines were also demonstrated by Fuji and Omron.

Toshiba will launch a new, micro-focus X-ray inspection system (TXView 4130 uFD) in April 2018 that boasts of a flat panel detection capability of 1.3 million pixels. Fuji demonstrated its new inserter, the sFAB-α, which is to be launched in 2018 across the globe. The insertion speed of this device has increased by 5,000 CPH. Musashi Engineering showcased its latest fully automated dispenser—FAD 2500, which the company claims has doubled its speed of dispensing as compared to its predecessor (FAD 2300). It comes with an automatic dispensing volume management system to ensure the dispensing volume remains constant.

Overall, the key movement is towards central information, thanks to the ‘IoTisation’ of the entire manufacturing line. Many vendors touted the IoT-capability of their equipment, showcasing software solutions that enable better preventive maintenance and provide critical data and reports, thus helping to optimise the production process.