What are the factors likely to shape the Indian electronics industry in the coming year and beyond? We talked to industry members about the trends expected to impact businesses in this sector, and the developments and opportunities companies can look forward to.

What are the factors likely to shape the Indian electronics industry in the coming year and beyond? We talked to industry members about the trends expected to impact businesses in this sector, and the developments and opportunities companies can look forward to.

By Sudeshna Das (with inputs from Baishakhi Dutta)

India’s electronic system design and manufacturing (ESDM) sector continues to be a critical force for growth, innovation and disruption, across multiple segments. Perhaps nothing demonstrates this more clearly than the widespread application of electronic components and products in sectors like lighting, automotive, communications, etc. Electronics has become an agent of change in these segments, enabling the creation of products that enhance efficiency. As we enter the next fiscal year of 2017-18, we anticipate even more opportunities for the electronics industry to meet the needs of the various sectors electronic products are used in.

Market projection

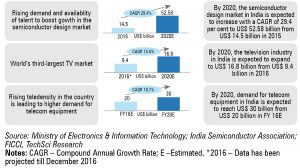

The Indian electronics market is one of the largest in the world and is expected to reach a turnover of US$ 400 billion in 2022, up from US$ 69.6 billion in 2012. According to an Indian Brand Equity Foundation (IBEF) report, the market is projected to grow at a compound annual growth rate (CAGR) of 29.4 per cent during the period 2015-2020 (Figure 1).

Total production of electronics hardware goods in India is estimated to reach US$ 104 billion by 2020.

The growing customer base and the increased penetration in the consumer durables segment has provided excellent scope for the growth of the Indian electronics sector. Also, greater digitisation could lead to increased broadband penetration in the country and open up newer avenues for companies in the electronics industry.

Applications that will drive the market

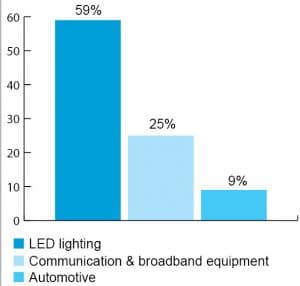

LED lighting applications will be the major driver for the Indian electronics market in the coming financial year. Considering the huge demand for communication and broadband equipment, including mobile handsets, this segment is also likely to drive the demand for electronic components and products. The market will also see demand from the automotive electronics segment. According to the survey participants, future growth in the electronics industry will predominantly come from the following top three demand-generating sectors (Figure 2):

1. LED lighting

2. Communications and broadband equipment

3. Automotive

Technologies that will shape the market

Technologies that will shape the market

The electronics industry is going through an exciting phase due to revolutionary changes in technology, the launch of innovative products and the challenge of global competition. This has made it necessary for electronic product and component manufacturers to focus on continuous improvements in order to stay ahead of the pack. Survey participants also shared some insights about emerging technology trends that will shape the market in India, and create more efficient, user-friendly products by using better production techniques. Here is a collation of their views and our analysis.

Evolution of components and products

- Miniaturisation: This refers to the creation of smaller devices or components for mechanical, optical and electronic products. Convergence is helping manufacturers to integrate multiple devices. The demand from consumers to reduce the size of the products, so that they are easy to manage, has also led to these products becoming smaller in size. The greater density of components in these products is usually made possible through VLSI designs. This also enables a lower cost of production, which translates to lower overall product pricing. Miniaturisation is on the rise and will impact the traditional components market as most of these components will get replaced by chip components and integrated circuits.

- Artificial intelligence: Consumers are becoming increasingly technology-conscious and are demanding products with built-in intelligence. This is resulting in electronics and consumer durable products being manufactured with intelligent functions and logic. For example, there are now washing machines that can sense the load and decide the appropriate washing cycles. Intelligence has moved beyond consumer products, and is also available in several medical electronics and industrial electronic products with CNC controlled functions.

- High frequency applications: Electronic integrated circuits and modules for high frequency applications will be in demand considering the increasing amounts of data that need to be transmitted within a very short time, whether it is in applications for communications, sensors or astronautics. Advances in integrated circuit technology are driving packaging and interconnect designers to accommodate more input/output connections and larger sized dies, which dissipate more power and operate at higher speeds. This, in turn, will generate demand for components and products suitable for high frequency applications.

Leading changes in LEDs

- There will be changes in ‘on board technology’ due to the use of IC based drivers to support touch based technology, which is the need of the hour for smart lighting systems. This, in turn, will reduce the number of components used in traditional drivers. Use of fewer components can reduce costs, while enhancing the efficiency of the final product.

- There will be higher usage of chip scale packaging (CSP) or ‘Flip Chip’ packaging technology to enhance lumen output while increasing the reliability of the final product. Use of CSP eliminates the traditional sub-mount, enabling manufacturers to directly attach the LED die to the PCB, allowing for overall system cost reductions.

- The introduction of driverless low voltage direct current (LVDC) operated products will enable energy saving by reducing AC-DC current conversion losses. This will also make the products compatible with solar photovoltaic systems, and help them run as LED-solar hybrid systems, which will be very useful in India.

- The shift in manufacturing techniques from through-hole to surface mount technology (SMT) will enhance efficiency while reducing operational costs. This, is turn, will help to achieve a breakeven point (BEP) quickly, in spite of relatively higher capital expenditure.

- Each of the IoT devices will require, at the very minimum, a microcontroller to add intelligence to the device, one or more sensors to allow for data collection, one or more chips for connectivity and data transmission, and a memory component. The connected devices that transmit information across the relevant networks will rely on innovations from semiconductor players—highly integrated microchip designs, for instance, and very low-power functions in certain applications.

- A new class of System-on-Chip (SoC) based devices, with provision for optimal power and connectivity features as well as with sensor integration, will be in demand to support the wide adoption of ÍoT. The first generation of such chips is already on the way, although it will probably be a few generations before chips can deliver all the functionality required.

- A new array of sensors based on micro-electromechanical systems (MEMS) technology are rapidly being developed to enable IoT applications beyond motion and image sensing to include those that measure humidity, altitude, food calorie composition, and human health indicators. This is a result of the increasing variety of consumer IoT applications such as wearables and clustered systems.