- Tesla’s Model Y stood firm as the globally best-selling model in electric vehicles, followed by BYD’s Song in Q4 2022

- Battery EVs accounted for almost 72% of all EV sales, while plug-in hybrid EVs accounted for the remaining 28% in the same quarter

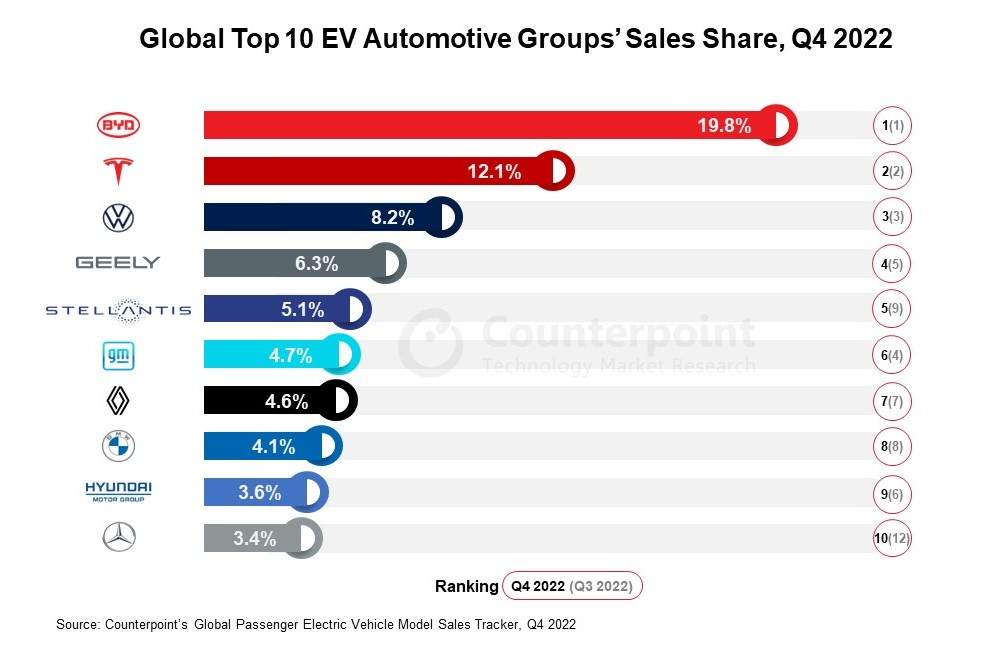

Going by the latest Counterpoint report, global passenger electric vehicle (EV) sales in Q4 2022 witnessed a major year-on-year hike of 53%, bringing the 2022 total to over 10.2 million units. Counterpoint’s global passenger electric vehicle model sales tracker for Q4 2022 found out that during this quarter, battery EVs (BEV) accounted for almost 72% of all EV sales, while plug-in hybrid EVs (PHEVs) accounted for the remaining 28%. While China, Germany and the US emerged as the top three EV markets, it is interesting to note that the top 10 EV automotive groups, which hold over 39 passenger car brands, contributed to almost 72% of all EV sales in 4Q22.

It is noteworthy that the top 10 EV models accounted for one-third of the total passenger EV sales in Q4 2022. While Tesla’s Model Y stood firm as the globally best-selling model, it was followed by BYD’s Song. Interestingly, seven out of the top 10 best-selling EV models in Q4 2022 were from BYD and Wuling, brands which are majorly China-operated. Resultantly, the report inferred that the country’s EV market is evolving positively.

“EV sales were at an all-time high during Q4 2022. The annual total for 2022 would have reached close to 11 million units had fresh COVID-19 infections not surfaced in China. COVID-19 infections in China during November and December affected automotive production and sales and disrupted the component supply chain. Despite these headwinds, Chinese brands managed to record strong growth. In fact, in 2022, many Chinese brands started to expand in markets like Europe, Southeast Asia and Latin America. Chinese brands are likely to dominate in Southeast Asia and Latin America as there are very few brands operating in these regions. But a fight for market presence is expected in Europe,” commented Research Analyst Abhik Mukherjee.

Senior Analyst at Counterpoint, Soumen Mandal commented, “EVs are becoming mainstream faster than expected. By the end of 2023, EV sales are expected to reach nearly 17 million units. This year, the US’ EV sales will see a boost as models become slightly more affordable due to the $7,500 tax credit. The end of the purchase subsidy in China might push EV manufacturers to increase their prices. BYD has already implemented one price hike in January. But these price hikes are unlikely to affect EV sales in one of the most matured EV markets. Lithium prices are also expected to come down during the second half of 2023, which will benefit EV sales.”

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. Counterpoint considered only BEVs and PHEVs, not the hybrid EVs and fuel cell vehicles (FCVs) in this study. Moreover, Sales refer to wholesale figures, i.e. deliveries from factories by the respective brands/companies.