Rapid growth in domestic components manufacturing is vital for the sustainable development of the Indian electronics industry. While there is a considerable increase in the demand for electronic components in the country, quite a few challenges still need to be addressed to meet this demand with local products.

Rapid growth in domestic components manufacturing is vital for the sustainable development of the Indian electronics industry. While there is a considerable increase in the demand for electronic components in the country, quite a few challenges still need to be addressed to meet this demand with local products.

By the ComConnect Consulting research team

Continuous tech developments and the absolute necessity for electronic products in modern life are driving the demand for electronic components. According to Global Industry Analyst Inc., the global market for electronic components is expected to reach US$ 191.8 billion by 2022, of which the Asia Pacific region is going to capture a dominant share. Following this global trend, the Indian electronic components market is also poised to grow significantly. This growth will be driven by rising local demand and growing disposable incomes. Apart from this, the adoption of high-end technology devices, technology-driven transformation such as the roll-out of 4G/LTE networks and the Internet of Things (IoT), policy and incentive boosts from the government like ‘Digital India’ and ‘Smart Cities’, wider broadband connectivity, e-governance programmes, etc, are all driving the accelerated adoption of electronic products.

Considering the mounting labour costs in China and the growing Indian market, global electronic product manufacturers have started relocating their manufacturing bases from China to other countries like India, Vietnam and Indonesia. This presents an excellent opportunity to the Indian electronic components manufacturing industry. Over the next five years, accelerated local manufacturing of electronic products to cater to growing domestic demand will drive the market for electronic components in India.

Market at a glance

The electronic components market can be broadly categorised as follows:

-

Passive components–capacitors, resistors, wound components and crystals

-

Active components–diodes, transistors, ICs and LEDs

-

Electromechanical components –PCBs, switches, relays, cables and connectors

-

Associated components—optical discs, magnets, RF tuners, heat-sinks, magnetrons, magnetic tapes, etc.

According to an Ernst & Young analysis, the Indian market is dominated by electromechanical components (such as PCBs and connectors), which account for around one third of the total demand, followed by passive components (such as resistors and capacitors). However, in recent times, the active components (like integrated circuits, diodes, etc) and the associated components (like optical discs, magnets, RF tuners, etc) have also witnessed significant growth in demand. While the industry’s composition is not predicted to change substantially, there is a rapid decline in the demand for products such as cathode ray picture tubes and CD/DVDs, which had till recently constituted a significant share of the manufacturing base and market. This is an outcome of changing technology and consumer preferences.

According to an Ernst & Young analysis, the Indian market is dominated by electromechanical components (such as PCBs and connectors), which account for around one third of the total demand, followed by passive components (such as resistors and capacitors). However, in recent times, the active components (like integrated circuits, diodes, etc) and the associated components (like optical discs, magnets, RF tuners, etc) have also witnessed significant growth in demand. While the industry’s composition is not predicted to change substantially, there is a rapid decline in the demand for products such as cathode ray picture tubes and CD/DVDs, which had till recently constituted a significant share of the manufacturing base and market. This is an outcome of changing technology and consumer preferences.

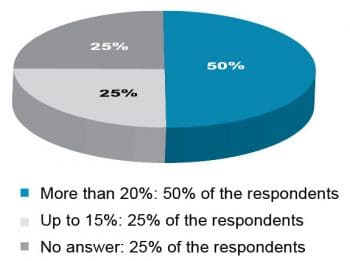

According to the Electronic Industries Association of India (ELCINA), the Indian electronic components manufacturing industry had a market size of ₹ 520.99 billion in FY 2016-17 and is expected to reach ₹ 594.97 billion in the FY 2017-18, with a year-on-year growth rate of around 15 per cent.

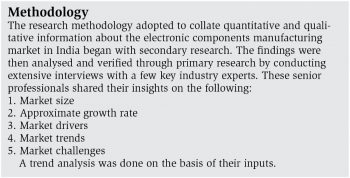

Fifty per cent of the respondents in our panel of experts predict that the Indian electronic component manufacturing industry will grow at a compound annual growth rate (CAGR) of more than 20 per cent till 2020 (Figure 1).

Demand-supply gap

Each one of the experts on our panel talked about the demand-supply gap in the Indian electronic components market with respect to domestic manufacturing. While quantifying the gaps, one of the industry experts indicated that 95 per cent of active components, 50-60 per cent of passive components and 30-40 per cent of electromechanical components and printed circuit boards (PCBs) are being imported at present.

According to ELCINA, the electronic components produced in India include, among others, picture tubes, diodes, transistors, power devices, resistors, capacitors, switches, relays, connectors, magnetic heads, etc.

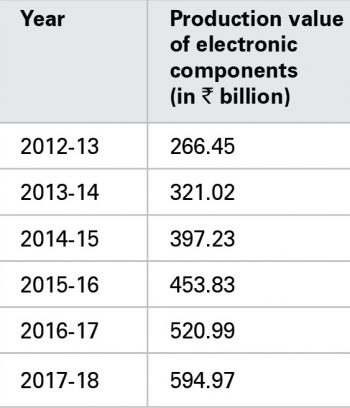

However, nearly 70 per cent of the demand for electronic components (Figure 3) is fulfilled through imports. Increasing reliance on imports for sourcing electronic components used in electronic products makes it crucial to enhance India’s manufacturing capabilities.

The countries from which we import include China, Taiwan, South Korea, Japan and a few European countries. The share of imports is higher for specialised and precision components like ICs, chip components, PCBs, LEDs, etc. For components that do not require sophistication in production, India has established near self-reliance. These components include cables, speakers, CRTs, etc. India has also been exporting these components to other countries.

Industry experts also mention that the value addition in electronic components is extremely limited as most of the raw materials are imported. The value addition in the electronic components industry does not exceed 40 per cent.

The Indian electronic components market is poised to grow driven by strong local demand for consumer durables and mobile devices. Moreover, rising labour costs in western countries and now also in Asia, have resulted in more outsourcing of electronics manufacturing services (EMS) to the country by both Indian and global OEMs who are looking for a larger share of the Indian market. The growth of niche EMS players in automotive, strategic and medical electronics has been significant. Availability of components and an effective supply chain is vital for EMS companies to grow. This, in turn, offers huge growth opportunities to the Indian electronic components manufacturing industry.

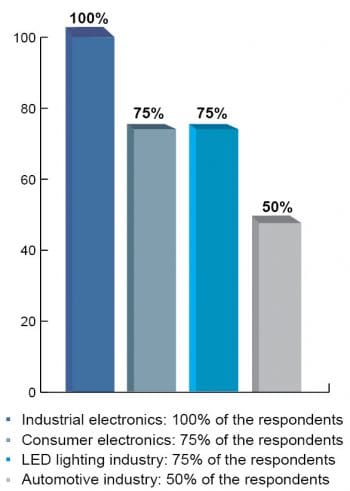

According to our panel of experts, the demand for components is highest from the industrial electronics segment in India. This is followed by consumer electronics and the LED lighting industry. However, the automotive industry also creates significant demand. Industries like medical electronics and strategic electronics are expected to witness substantial growth in the near future (Figure 4).

Technology trends shaping the market

The Indian electronics industry is going through an exciting phase with growth in demand due to the central role played by electronics in every aspect of our lives, the revolutionary changes in technology, the launch of innovative products and the challenge of global competition. This has led electronic product and component manufacturers to focus on continuous improvement in their products in order to stay ahead of the pack, resulting in the following trends.

Convergence of technologies: Convergence allows a single device to use multiple technologies/services. It has become a reality in the last couple of years with the launch of mainline products that enable convergence. A smartphone is a key example of the advent of convergence, as it allows communication and computing using the same device. Convergence is moving beyond mobile phones to several other electronic devices like music players, IPTVs, iPads, etc. This trend is expected to convert most electronic devices into multi-utility products, thereby requiring high tech electronic components and technology.

Miniaturisation: This refers to the creation of smaller scale devices or components. The dawn of convergence has led manufacturers to integrate multiple functions onto one device. At the same time, there has been demand from consumers to reduce the size of the products to make them easy to manage. Miniaturisation results in greater density of components, which is usually possible through VLSI designs. This also enables lower cost of production, resulting in a fall in the overall product pricing. Miniaturisation is expected to increase and will impact the traditional component market, as these will be replaced by chip components and integrated circuits.

Artificial intelligence: Consumers are becoming increasingly technology-conscious and are demanding products with built-in intelligence. This is resulting in electronics and consumer durable products being manufactured with intelligent functions and logic. For example, washing machines available now can sense the load and decide the appropriate washing cycles. Intelligence has moved beyond consumer products, and is also available in several medical electronics and industrial electronic products with CNC controlled functions.

Going green: Manufacturers across the globe have started moving towards green electronics and sustainable development with the implementation of RoHS (restriction of hazardous substances) and WEEE (waste electrical and electronic equipment) regulations. In line with this trend, the Indian government too has issued notifications to regulate the use of hazardous substances (lead, cadmium, mercury, etc) and the proper disposal of WEEE. Similarly, rules have been notified with respect to energy efficiency norms and labelling of most consumer electronic durables.

The traditional components will increasingly face stiff competition from integrated circuits and surface mount devices (SMD), which will replace them in several electronic products. Therefore, in the near future, it is important for component manufacturers to shift focus from discrete components manufacturing to integrated components manufacturing in line with technological trends.

Moving forward

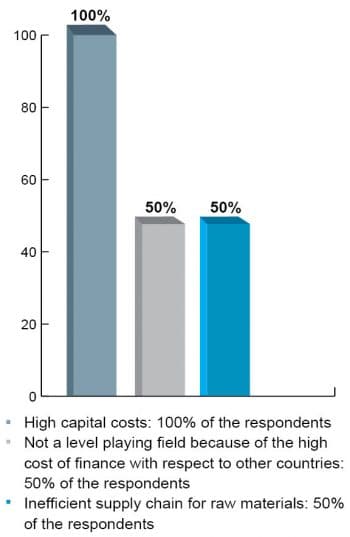

The Indian electronic components industry needs to transform into a best-in-class manufacturing industry from a need based manufacturing one, and look at the entire world as its market. However, there are a few challenges here. Our panel of experts identified the top most challenges (Figure 5) as follows:

-

High capital costs compared to other countries

-

Inefficient supply chain for raw materials

-

Other challenges include:

-

Non-availability of advanced manufacturing equipment

-

Logistics inefficiencies and infrastructural bottlenecks

-

Lack of access to new technology and state-of-art capital equipment

-

Lack of skilled labour

-

Capability limitations

Only if these challenges are addressed will Indian electronic components manufacturing in India really grow to meet the country’s demands and serve the global market.