The CBEC (Central Board of Excise and Customs) has notified the Revised Duty Drawback Rates Schedule for 2017-18, applicable w.e.f. October 1, 2017, with respect to specified exports and subject to compliance with the procedural requirements notified from time to time.

The CBEC (Central Board of Excise and Customs) has notified the Revised Duty Drawback Rates Schedule for 2017-18, applicable w.e.f. October 1, 2017, with respect to specified exports and subject to compliance with the procedural requirements notified from time to time.

By Baishakhi Dutta

The introduction of the Goods and Services Tax (GST) has so far received a positive response from the Indian Electronics System Design and Manufacturing (ESDM) industry. Consolidated tax calculation and proper invoice generation is making business transactions smoother and easy to track. In the light of this initiative, the Central Board of Excise and Customs (CBEC) has revealed the new duty drawback rates for the ESDM industry, which came into effect from October 1, 2017.

To analyse the impact of the revised duty drawback rates, the Electronics Bazaar team reached out to a few experts in the industry, and was pleased to know that industry stalwarts are welcoming these newly declared rates as a positive change for the ESDM industry, especially with regard to exports. Veterans are of the opinion that these rates will streamline the export procedures in India.

“The drawback on active electronic components 8541/8542 is just 1 per cent, as most of the duties are VAT-able and recovered earlier. But this applies to exporters registered for taxes. Many small exporters may have much more in recovered taxes in their product costs. But, more significantly, 1 per cent is too small an amount; so any effort by the government to collect it will cost more than the refund itself. So these amounts will remain unclaimed. The government should automatically credit the same to the respective bank accounts to bolster its ease-of-doing-business initiative,” says Vijay Kumar Gupta, CEO, Kwality Photonics Private Limited.

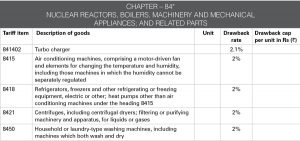

Let’s take a look at these revised drawback rates pertaining to Chapters 84 and 85 (see table).

**Notes and conditions

(1) The tariff items and descriptions of goods in the said schedule are aligned with the tariff items and descriptions of goods in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) at the four-digit level only. The descriptions of goods given at the six-digit, eight-digit or modified six- or eight-digit levels in the said schedule are in several cases not aligned with the descriptions of goods given in the First Schedule to the Customs Tariff Act, 1975.

(2) The general rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 shall, mutatis mutandis, apply for classifying the export goods listed in the said schedule.

(3) Notwithstanding anything contained in the said schedule:

- Any identifiable ready-to-use machined part or component predominantly made of iron, steel or aluminium, made using the casting or forging process, and not specifically mentioned at the six-digit, or higher level in Chapters 84, 85 or 87, except those classifiable under the headings 8432, 8433 or 8436, may be classified under the relevant tariff item (depending upon the material composition and making process) under the headings 8487, 8548 or 8708, as the case may be, irrespective of the classification of such parts or components at the four-digit level in Chapters 84, 85 or 87 of the said schedule.

(4) The figures shown in Column 4 in the said schedule refer to the rate of drawback expressed as a percentage of the free on-board value or the rate per unit quantity of the export goods, as the case may be.

(5) The figures shown in Column 5 in the said schedule refer to the maximum amount of drawback that can be availed of per unit specified in Column 3.

(6) An export product accompanied with a tax invoice and forming part of an export project (including turnkey exports or supplies) for which no figure is shown in Column 5 in the said schedule, shall be so declared by the exporter and the maximum amount of drawback that can be availed under the said schedule shall not exceed the amount calculated by applying the ad-valorem rate of drawback shown in Column 4 to one-and-a-half times the tax invoice value.

(7) The rates of drawback specified against the various tariff items in the said schedule in specific terms or on an ad valorem basis, unless otherwise specifically provided, are inclusive of the drawback for packing materials used, if any.

(8) Drawback at the rates specified in the said schedule shall be applicable only if the procedural requirements for claiming drawback as specified in Rules 12, 13 and 14 of the said rules are satisfied, or unless they are otherwise relaxed by the competent authority.

(9) The rates of drawback specified in the said schedule shall not be applicable to the export of a commodity or product if such a commodity or product is:

(a) Manufactured partly or wholly in a warehouse under Section 65 of the Customs Act, 1962

(b) Manufactured or exported in discharge of an export obligation against an Advance Authorisation or Duty Free Import Authorisation issued under the Duty Exemption Scheme of the relevant Foreign Trade Policy:

Exported against Special Advance Authorisation issued under paragraph 4.04A of the Foreign Trade Policy 2015-20 in discharge of export obligations in terms of Notification No. 45/2016-Customs, dated August 13, 2016, where the rates of drawback are specified;

(c) Manufactured or exported by a unit licensed as a 100 per cent Export Oriented Unit in terms of the provisions of the relevant Foreign Trade Policy;

(d) Manufactured or exported by any of the units situated in Free Trade Zones, Export Processing Zones or Special Economic Zones;

(e) Manufactured or exported availing the benefit of the Notification No. 32/1997-Customs, dated April 1, 1997.

(10) Whenever a composite article is exported for which any specific rate has not been provided in the said schedule, the rates of drawback applicable to various constituent materials can be extended to the composite article according to the net contents of such materials on the basis of self-declaration by the exporter to this effect, and in case of doubt or where there is any information contrary to the declarations, the relevant customs officer shall verify such declarations.

(11) All claims for duty drawback at the rates of drawback notified herein shall be filed with reference to the tariff items and descriptions of goods shown in Columns 1 and 2 of the said schedule, respectively. Where, in respect of the export product, the rate of drawback specified in the said schedule is nil or is not applicable, the rate of drawback may be fixed, on an application by an individual manufacturer or exporter in accordance with the said rules. Where the claim for duty drawback is filed with reference to a tariff item of the said schedule and it is for the rate of drawback specified herein, an application, as referred under Sub-rule (1) of Rule 7 of the said rules, shall not be admissible.

(12) The amount referred in Sub-rule (3) of Rule 7 of the said rules, relating to the provisional drawback amount as may be specified by the Central Government, shall be equivalent to the drawback rate and drawback cap shown in Columns 4 and 5 in the said schedule for the tariff item corresponding to the export goods, if applicable, and determined as if it were a claim for duty drawback filed with reference to such a rate and cap.

- This notification shall come into force on October 1, 2017.

**Source: CBEC website