The growth of the Indian electric vehicles market is likely to drive demand for power electronics components and products.

The growth of the Indian electric vehicles market is likely to drive demand for power electronics components and products.

By the ComConnect Consulting research team

Continuous regulatory pressures to curtail the environmental ill-effects associated with internal combustion engines (ICEs), coupled with the availability of advanced technologies for electric power trains and storage systems (batteries, etc) have enhanced the demand for electric vehicles (EVs).

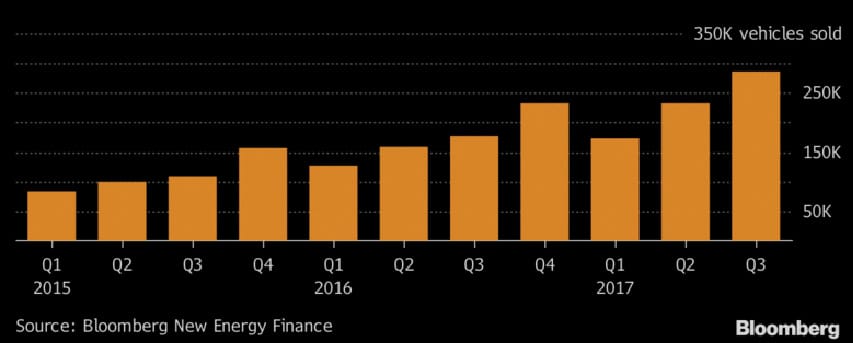

Large-scale adoption of electric vehicles (EVs) is seen as vital to cutting the carbon emissions that drive climate change and in dealing with urban air pollution, the latter being directly linked to many premature deaths every year. Globally, the sales of EVs have witnessed phenomenal growth—287,000 units in Q3 ended in September 2017, 63 per cent higher than the same quarter a year ago and up 23 per cent from the second quarter, according to a report by Bloomberg New Energy Finance.

According to Reportbuyer, the global electric vehicle (EV) market is growing at a compound annual growth rate (CAGR) of 21.27 per cent for the forecast period of 2017-2026. The market is driven by growing concerns about the emissions of CO2 and other greenhouse gases, the availability of low cost Li-ion batteries and various government initiatives that are encouraging the use of EVs.

The Indian scenario

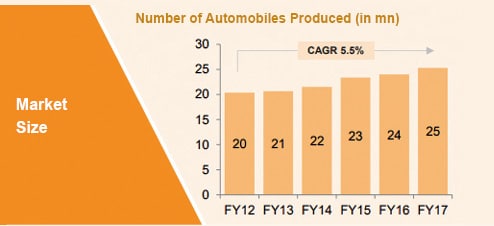

The Indian automobile industry is one of the largest and fastest-growing auto markets (Figure 2) in the world, and it accounts for 7.1 per cent of the country’s Gross Domestic Product (GDP). It is estimated to grow at around 10-15 per cent per annum, to reach US$ 16.5 billion by 2021 from around US$ 7 billion in 2016. The Indian auto sector also accounts for a significant share of the country’s manufacturing facilities and is expected to increase this share to 25 per cent by 2022, significantly up from 15 per cent in 2017.

A majority of India’s auto industry is driven by vehicles running on fossil fuels. However, with increasing environmental concerns, the country has taken baby steps towards transforming its auto market to a more sustainable model–one running on renewable fuel.

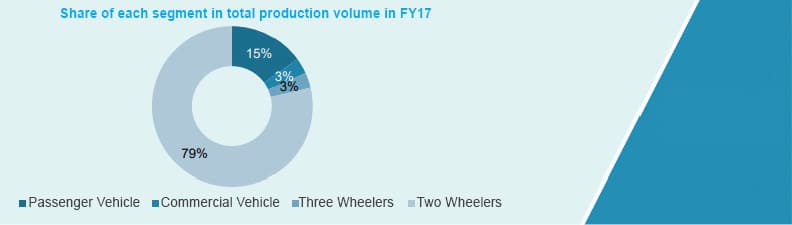

According to a study by ASSOCHAM, conducted along with global advisory services firm Ernst and Young, the Indian EV industry accounts for less than 1 per cent of total vehicle sales and is dominated by two-wheelers (95 per cent).

India’s EV industry is in a nascent stage in comparison with the other international markets such as US, China and Europe. China leads, having accounted for nearly a 50 per cent share of the global EV market in 2016. Currently, India’s share of the global EV market is an insignificant 0.1 per cent. However, a sea change is definitely anticipated for the county’s EV industry with a major thrust being given by the government.

India’s EV industry is in a nascent stage in comparison with the other international markets such as US, China and Europe. China leads, having accounted for nearly a 50 per cent share of the global EV market in 2016. Currently, India’s share of the global EV market is an insignificant 0.1 per cent. However, a sea change is definitely anticipated for the county’s EV industry with a major thrust being given by the government.

According to a study by Persistence Research, the Indian EV market is expected to expand at a CAGR of 77 per cent in terms of value during the period 2017-2025. Market players are focusing on expanding their presence in India where the EV industry is growing at a rapid rate. Key players plan to enter into tie-ups with local vendors, distributors and aftermarket companies to promote their products. The EV market in India is expected to create lucrative opportunities for EV manufacturers as well as for vehicle component makers in the near future. Owing to this fact, huge investments are already being planned by many key vendors in the Indian market. The passenger car segment is predicted to be the most attractive segment in the India EV market during the forecast period.

Policy boost

On account of the pressing environmental concerns, governments across the world are putting regulatory pressure on gasoline vehicle makers, thereby increasing their prices. Governments are also taking initiatives to promote the sales of EVs.

In India, too, the government has made a string of announcements that are set to change the landscape of the domestic auto industry. Chief among the announcements are the immediate shift towards Bharat Stage VI-emission norms and the planned shift towards only EVs in the longer term. Stricter emission norms, falling battery prices and increasing consumer awareness are continually driving EV adoption. The government had initially set a deadline of 2030 for removing all fossil fuel based vehicles from Indian roads. However, a recent announcement has done away with the specific target year though still remaining aligned with the shift towards EVs, in principle. Individual states, though, have begun to formulate their own EV policies, with Karnataka and Maharashtra leading the pack.

The Indian government introduced the FAME India [Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India] scheme in 2015, with the objective of developing the market for hybrid/electric vehicles and building their manufacturing ecosystem. The scheme has four focus areas—technology development, demand creation, pilot projects and charging infrastructure. Phase-I of the scheme has already been implemented for a period of two years, i.e., FY 2015-16 and FY 2016-17, commencing from April 1, 2015. The FAME scheme targets the production of nearly 7 million EVs by 2020. Like China, India is also planning to spend largely on subsidising local companies, and pushing them to the forefront of electric mobility technologies. The FAME India scheme is weighted more towards consumer incentives rather than incentivising local R&D, which makes sense, since the country stands to gain from the technological advances already made globally.

In order to balance foreign investments and promote domestic industry, the government has also taken a number of steps like increasing the customs duty on 53 auto components, on CKD components for cars and commercial vehicles as also on commercial vehicles themselves, to provide added protection to the domestic industry and encourage investors to set up facilities in the country, rather than import goods.

India’s EV sales increased by 37.5 per cent to 22,000 units during FY 2015-16 and are poised to rise further on the back of cheaper energy storage costs. In order to keep up with the growing demand, several automakers have started investing heavily in various segments of the industry during the last few months. For example, Mahindra and Mahindra Ltd has partnered with Uber for deploying its electric sedan e-Verito and its hatchback e2o Plus in New Delhi and Hyderabad. The industry has attracted foreign direct investment (FDI) worth US$ 17.91 billion during the period April 2000 to September 2017, according to data released by the Department of Industrial Policy and Promotion (DIPP).

The Centre has also boosted demand for EVs by planning to replace its own fleet of vehicles to EVs. EESL, which is a joint venture of PSUs under the power ministry, had floated a global tender for 10,000 electric vehicles to replace the government’s fleet.

Challenges to be addressed

Though the automobile landscape is changing, there are still major barriers to the adoption of EVs. The major roadblocks include high prices, inadequate charging infrastructure, the limited range that vehicles can run on a single charge and the limited available options.

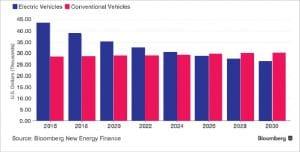

Price: This is a significant factor in automobile purchase decisions. While EVs have a much lower running cost due to cheaper fuel, the upfront cost is significantly higher than their gasoline counterparts. However, this is set to change as the cost of one expensive component, the battery, is expected to drop over time. Research from Bloomberg New Energy Finance indicates that battery costs (that currently account for about half the cost of EVs) will fall by about 77 per cent between 2016 and 2030, and EVs will cost less than gasoline-fuelled vehicles by 2026 (Figure 3).

A panel headed by cabinet secretary P.K. Sinha has recommended the commercial use of ISRO’s lithium-ion battery technology under the ‘Make In India’ initiative for electric vehicles, Livemint has reported. Presently, lithium-ion batteries are not manufactured in India on a commercial basis and the country has to depend on imports from Japan or China.

Charging infrastructure: For consumers to consider purchasing EVs, the charging infrastructure needs to be developed in line with the current infrastructure of fuel pumps. Charging infrastructure typically includes both private and public charging stations, and is a vital part of the entire EV ecosystem. In fact, besides the upfront cost of the vehicle, availability of user-friendly charging infrastructure is the biggest factor that determines the success of a country’s EV plan. India currently has nearly 56,000 traditional fuel stations compared to just 222 community EV charging stations. Not only is developing the charging infrastructure ecosystem, both in urban and remote areas, imperative for EV adoption, the charging stations need to be connected to the relevant electricity grid – preferably from renewable sources such as wind or solar. Related policies also need to be revisited to assess whether charging stations will be regarded as electricity providers and hence governed by the Electricity Act.

Energy Efficiency Services Ltd (EESL) has invited bids for 2,000 electric vehicle chargers for the second phase of its EV programme, which will see the roll-out of 9,500 electric vehicles across different states.

Range: This refers to the distance an EV can run without requiring a recharge. EVs available in the market today have a relatively low range and are more suited for just city use. To be able to realise its full potential akin to gasoline vehicles, battery capacity needs significant improvement. However, with continued breakthroughs in battery research, EVs with a higher range are under development.

While there are EVs in the market with a range as high as 400km-500km, these largely fall in the high price segment. Cars within the more affordable segment typically average 200km-300km per charge. The three new models being planned for launch by Mahindra in the next couple of years will probably have ranges between 200km-350km.

| EVs to drive huge demand for IGBTs |

| Yole Développement, a global market research company, forecasts that the EV market will help drive the growth of the insulated-gate bipolar transistors (IGBTs) market to US$ 6 billion by 2018. IGBTs have long been at home in the switch power supply market, and they comprise the largest segment of the market for EV power systems. Vehicle electrification involves voltage levels between 12V and 400V, and requires high-power IGBT modules for drive and traction applications. |

Opportunities for the electronics industry

EVs are being designed with two motors per car, not one, which means many more motor controllers are needed. Each vehicle has a charger and a battery management system on board, with both using power electronics. Moreover, EVs have electronic suspension, which means a bigger market for power electronic devices and components, including power management semiconductors, etc.

The major electronic components used in EV systems include microcontrollers, analogue gate drivers, power MOSFETs and IGBTs, rectifiers, EEPROM memories, protection devices, voltage regulators, and ICs for the power management and battery monitoring systems.

Within the EV market, solutions to optimise power efficiency, ranging from high-power modules, microcontrollers and power semiconductors to sensors and discrete components, are in high demand. The first area where these are used is the main inverter, which controls the electric motor to determine driving behaviour and captures kinetic energy released through regenerative braking, feeding recovered energy back to the battery. The second is the DC-DC converter module, which supplies the 12V power system from the high-voltage battery. Then come the auxiliary inverters/converters, which supply power on demand to systems such air conditioners, the electronic power steering system, oil pumps, and cooling pumps. The fourth area is the battery management system, which controls the battery state during charging and discharging to enable the longest possible battery life. And the fifth is the on-board charger unit, which allows the battery to be charged from a standard power outlet.

Complete solutions for EVs, like for electric traction and energy recovery, power steering, automated manual transmission, the cooling system, pumps, and power management are also in demand.

Innovative automotive applications like intelligent power switches for anti-lock brake systems, micro-electromechanical systems (MEMS), inertial sensors for automotive airbags and the telematics microprocessors also see demand.

Wheels are another area of interest. They may become electrical, generating electricity, while hybrids may have thermoelectrics on exhaust systems and turbines, generating useful kilowatt level power; their management will require electronics.

Power trains for electric vehicles on land, water and air are evolving rapidly and by far the biggest market will be for vehicles on land, particularly on-road, and mainly for cars followed by buses.

Moving forward

The desire for a longer driving range between charges, faster battery charging times, increasing electronics integration for infotainment, safety and security, and other applications may drive advances in areas beyond just power management, thus increasing the total electronics content in EVs.

For example, the suspension will no longer be mechanical but an electrical active suspension generating electricity and using it, in part, to manage itself to deliver a far better ride and minimise the use of fuel. This, in turn, will involve the use of more electronic components and devices.

Moreover, car entertainment systems with near-field communications technology or NFC, vehicle access, in-vehicle networks, and all features related to secure connected mobility will enhance the electronics content in EVs. Therefore, car-to-car communication, car-to-infrastructure communication, remote car management, and broadcast reception solutions will be in demand.