The Ministry of New and Renewable Energy (MNRE) has released a concept note of a proposal to build out India’s manufacturing supply chain, including polysilicon, wafers/ingots, cells and modules.

MNRE is proposing a slew of subsidies and incentives including direct financial support of more than ₹110 billion for manufacturers to expand and upgrade, a 12 GW Central Public Sector Undertaking (CPSU) domestic content requirement (DCR) program to create robust domestic demand, an increasing DCR requirement from modules to polysilicon by year, 30 percent central financial assistance, cheaper loans, a custom duty exemption, and cheaper power.

The concept note is open to comments and suggestions until December 31, 2017. The program aims to strengthen the Make in India campaign, reduce the country’s dependence on foreign manufacturers, and make domestic manufacturers competitive with their international counterparts.

The proposal borrows heavily from subsidy programs for solar manufacturers in China that helped the country become the largest solar component manufacturer in the world. However, the scale of India’s proposed subsidies is much smaller than what the Chinese government has used in the past.

Indian solar installations have risen from just 6 MW in 2009 to a cumulative total of approximately 20 GW to date, with another 9.5 -10 GW of installations expected this year alone according to the Mercom India Q3 Market Update. But domestic solar manufacturers have not been able to capitalize on this robust growth as they have not been able to compete on scale or cost with their Chinese counterparts who are supported heavily by the government.

Since the National Solar Mission was implemented in 2009, two anti-dumping cases have been filed by Indian manufacturers against exports from China and other countries. The first case was dismissed in 2014 without the imposition of any protectionist duties. The second case is ongoing and the industry widely expects a duty to be imposed this time around as the government is now on board with plans to help local manufacturers snag a larger piece of the domestic solar market.

The government is planning a three-pronged approach to support local manufacturers that includes:

1. leveling the playing field with the imposition of anti-dumping duty on cells and modules,

2. creating demand through a DCR program, and

3. supporting manufacturers financially by providing multiple subsidies outlined in this policy proposal.

At the moment, the only available incentive is limited to PV manufacturers under the Modified Special Incentive Package Program (M-SIPS). The program provides a 20-25 percent capital subsidy and other tax incentives for companies that manufacture electronic goods, which PV falls under. However, no solar PV applicants seem to have been approved under this program so far.

It is difficult to ascertain the actual solar cell and module manufacturing capacity that currently exists in India.

In the concept note, MNRE pegs current solar cell manufacturing capacity at 3.1 GW per year and module manufacturing capacity at 8.8 GW/year. However, a survey of manufacturers conducted by Mercom for its Mercom Q3 Solar Market Update uncovered a slightly higher self-reported domestic module manufacturing capacity of 9.4 GW/year, and lower solar cell manufacturing capacity of 2.9 GW/year.

But, many manufacturers in our survey actually believe the real capacity is must lower, at around 4 GW/year for modules and approximately 1.5 GW/year for cells. These lower numbers are attributed to obsolete, outdated manufacturing lines that cannot produce quality products at competitive prices.

It is important for the government to understand exactly what India’s true module manufacturing capacity is before setting goals and structuring a subsidy package.

With this proposal, India’s solar sector appears to be on its way to becoming a government-run program complete with central planning – much like the Chinese – and could take away some of the entrepreneurial dynamism from the market.

Key Subsidies Proposed to Help Local Manufacturers

· The policy proposes direct financial support of more than ₹110 billion ($7,150 billion) and large indirect support by way of concessions to support solar cell and module manufacturers expand and upgrade their existing facilities or set up new manufacturing facilities.

· To ensure a guaranteed market, the policy proposes a 12,000 MW CPSU (this is higher than the earlier proposed 7.5 GWs) program that would have to comply with World Trade Organization (WTO) rules.

· To encourage continuous quality improvement, the DCR would be reviewed every year to earmark part of it for higher quality requirements. This is a page directly out of China’s Top Runner program, which sets higher efficiency targets each year to promote technology improvements.

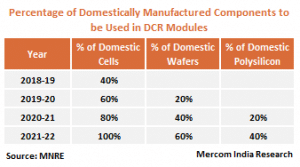

· It is proposed to encourage a gradual shift in the production capacity for the entire manufacturing chain by earmarking certain components of the DCR category for earlier stages. This earmarking would be gradually increased over time to encourage manufacturers to vertically integrate. At the initial stage, the policy will target the creation of 10 GW of manufacturing capacity over a period of five years, with a focus on both integrated silica-to-modules packages and also for intermediate standalone packages or combinations.

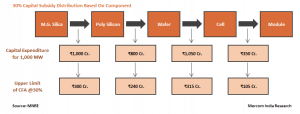

· Central Financial Assistance (CFA) in the form of 30 percent capital has been proposed to setup or upgrade domestic manufacturing capacity. The CFA will be allocated based on what component is being manufactured.

· In cases where domestic manufacturing capacity is being set up without taking recourse to use the capital subsidy, an interest reduction of 3 percent will be provided for loans taken through nationalized banks for manufacturers that set up new capacity.

· To create a sustainable ecosystem and for demonstration purposes, four PSUs will be supported to setup 1 GW each of polysilicon to module manufacturing facility. This is another example of more government getting into what the private sector should be doing. The proposal is justified in the document by saying “the PSUs have acted as leaders in capital intensive industry, and it is only later the private sector starts participating when the eco system is ready.” But, this has not been the case, and private companies have been the ones that have taken the leadership from the beginning in the Indian solar industry.

· Capital goods required to set up a solar manufacturing facility would be exempt from the customs duty.

· To offset high power costs, it is proposed that solar manufacturing units be allowed to set up solar power projects of twice the required capacity. They would also be allowed to bank surplus production during the day into the grid and draw down the same amount of power during the night.

If implemented, these proposals would most likely help domestic manufacturers secure a larger share of the Indian solar market. However, the government must walk a thin line to stay in compliance with WTO rules. A country can subsidize goods and services in its domestic markets as long as it does not discriminate against imported goods in any way. Where it gets tricky is when it comes to exports. If a company manufactures solar components cost effectively using some of the above-mentioned subsidy support, it may itself become a target for anti-dumping duties when its goods are exported to another country.

If these incentives are seriously implemented and there is clear visibility for the next five years of market demand, then more manufacturers from China and other countries may decide to establish manufacturing units in India. Chinese solar equipment company Longi Green recently announced a plan to setup a 500 MW module plant in Andhra Pradesh and other Chinese manufacturers have also expressed interest in establishing their own Indian manufacturing plants if they can obtain better government incentive packages and clear installation goals with consistent auction announcements.

Mercom also recently reported that the Ministry of New and Renewable Energy (MNRE) is preparing to announce a spate of tenders for solar projects in the coming four months, starting in December 2017. Under the plan, the MNRE says it will work alongside states to announce the tenders needed to reach 20 GW of ground-mounted capacity in solar parks in the 2017-18 fiscal year. Of the 20 GW, 3.6 GW has already been tendered while another 3 GW is set to be tendered in December 2017, followed by 3 GW in January 2018, 5 GW in February 2018, and 6 GW in March 2018. Another 30 GW is expected to be tendered in 2018-19 with 30 GW to follow in 2019-20.

Overall the manufacturing support policy proposal is a very positive development for domestic manufacturers, but careful attention should be paid so component costs do not end up so high that it throttles the extremely cost sensitive project development activity.