The Indian LED lighting industry is expected to grow tremendously, even over the long term, on account of the demand for a smart, connected lifestyle and for energy-efficient products.

By Sudeshna Das

The lighting market in India is evolving rapidly, moving from using conventional products to LEDs. This transition is driven by an increasing number of government initiatives for energy conservation, rising consumer awareness about energy-efficient products, and innovative products offered by the industry that are in sync with the overall trend of digitisation. This evolution indicates a tectonic shift in technology from electrical to electronics. In turn, this may represent a significant growth opportunity for companies offering electronic hardware/components and solutions used in LED lighting. This move to LEDs will also benefit prototype designers, electronics manufacturing services (EMS) providers and original equipment manufacturers (OEMs).

In this report, we try to provide insights about India’s LED lighting ecosystem, focusing primarily on market size, opportunities, major demand generating applications, hindrances that impact growth, emerging technology trends and the impact of the Goods and Services Tax (GST).

Methodology

Inputs from eight senior industry experts and members from across India’s LED lighting ecosystem were taken for this report. The experts are from:

- Large scale LED lighting companies/OEMs

- SME LED lighting companies/OEMs

- Electronic component manufacturers

- Industry associations

Market at a glance

India, being the second most populous country in the world and fifth major electricity consumer, has been experiencing an ever-widening demand-supply gap in electricity. Consequently, the market for energy-efficient products such as LED lights is bound to grow. All the survey participants felt that the moderately-growing lighting industry will now move at a faster pace, as the government is encouraging the use of LED lights in a big way. Other drivers are the Smart Cities project, and the increasing demand for a smart, connected lifestyle and energy-efficiency measures.

According to a report by TechSci (a global research based consulting firm), the LED lighting market in India is projected to register a CAGR of over 30 per cent during 2016-2021. The Electric Lamp and Component Manufacturers Association of India (ELCOMA) shares that the LED market in India is expected to grow to ₹ 216 billion by 2020. This leap will result in the LED market accounting for about 60 per cent of India’s total lighting industry (approximately ₹ 376 billion) in 2020.

The key factors that are expected to boost the market include falling LED prices coupled with favourable government initiatives that provide LED lights at a subsidised cost and promote LED street lighting projects. Moreover, rising consumer awareness about the cost-effectiveness, enhanced life, better efficiency and inherent eco-friendly nature of LED lights will continue to drive volume sales from the industrial, residential and commercial sectors.

Government facilitating wide scale implementation of LED lighting

According to a Press Information Bureau (PIB) announcement, by 2019, 770 million LED bulbs and 35 million LED streetlights will be deployed to replace conventional lights.

Under the Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), 27.3 million LED bulbs have to be distributed to BPL households.

Over 2.1 million conventional streetlights have already been replaced with LED streetlights across the country, under the Street Lighting National Programme (SLNP). Energy Efficiency Services Limited (EESL), a public energy services company under the administration of the Ministry of Power, government of India (GoI) is the implementing agency for SLNP.

The installation of LED streetlights has resulted in annual energy savings of 295 million kWh, avoided capacity usage of over 73MW and reduced carbon emissions by 230,000 million tonnes annually. The project has been implemented across 23 states and union territories.

| State | Number of streetlights | Energy saved per year (kWh) |

| Rajasthan | 704,891 | 99,054,808 |

| Andhra Pradesh | 586,037 | 82,352,849 |

| Delhi | 264,185 | 37,124,579 |

| Gujarat | 200,536 | 28,180,321 |

| Goa | 94,856 | 13,329,639 |

Table 1: Top five states that have replaced conventional streetlights with LED lights (Source: Press Information Bureau)

Current opportunities

LEDs are versatile products and so can be used for residential lighting, street lighting, downlights, landscaping, monument lighting, signage, traffic signals, security lights, industrial lighting, office space lighting, automotive lighting and much more. Low energy consumption, low costs, modular designs and ease of use have made LED lighting the first choice in industrial, commercial and domestic applications.

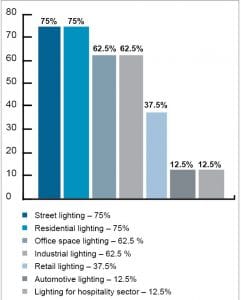

According to survey participants, the top four demand-generating application areas (Figure 1) are:

1. Street lighting

2. Residential lighting

3. Office space lighting

4. Industrial lighting

The demand for streetlights is driven by government initiatives, while in residential and office spaces, demand is mainly driven by increasing consumer awareness about energy-efficient products with more functionalities. In industrial areas, LEDs are used in warehouses, manufacturing floors, etc. In the hazardous work areas across industries, too, most of the new lighting being used is LED based.

The demand for LED lighting in India is still mostly driven by its adoption in metro cities, mainly because of better awareness and higher socio-economic growth. However, the demand from Tier-II cities is also expected to grow based on requirements from the street lighting and industrial lighting domains.

Currently, though, demand for LED lighting from rural India is still not significant. The government (through EESL) will be implementing the first rural LED street lighting project by retrofitting 1 million conventional streetlights with LED lights in the gram panchayats of seven districts of Andhra Pradesh under the Street Lighting National Project (SLNP). Further expansion of such initiatives across the country will open up new markets for the LED lighting industry.

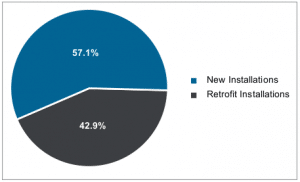

According to 57 per cent of the survey participants, retrofit installations are more in demand compared to new installations (Figure 2).

GST: Boon or bane?

According to survey participants, till now, the possible impact of GST on the LED lighting industry is not entirely clear. However, their opinions are summarised below.

Pros

- A unified tax structure may help to create a unified market across the country.

- A unified tax structure may encourage big industries to support the formation of manufacturing clusters to avoid logistics costs, which were earlier nullified by differences in taxes across the country.

- Non-tax payers, who account for 30-35 per cent of the LED industry, have been enjoying an unethical price advantage compared to the big brands. Implementation of GST will compel non-tax compliant players to adhere to the tax system. This will have a long term positive impact on the market as well as give genuine brands a fair advantage.

- Less paperwork and borderless transits may bring down costs and delivery timelines, creating benefits across the value chain.

- GST will improve the efficiency of the supply chain across industries, including the LED lighting sector.

Cons

- The rate of GST on LED lights or fixtures including LED lamps is 12 per cent, whereas the components and raw materials used for manufacturing LED lamps have GST rates ranging from 18 to 28 per cent. This anomaly may result in huge revenue leakage, and might even lead to unethical accounting practices like under-invoicing.

- Metal core printed circuit boards (MCPCB) and LED fixtures will be roughly charged 12 per cent GST. This may result in higher imports of fixtures rather than them being assembled in India.

- Some of the imported raw materials, which have been sourced from the countries under category C of the Foreign Trade Policy 2015-20, were earlier attracting tax at the rate of 2 per cent, but after GST implementation these will come under the 28 per cent tax slab. This will make local manufacture of products that use these materials unviable. Similarly, most of the electronic components fall under the 18 per cent category, up from 6 per cent earlier.

- In the case of most SMEs, some amount of work is done by unregistered dealers. Earlier, such services attracted 0 per cent tax as the turnover of those unregistered dealers tended to be very low. After GST implementation, companies are bound to pay 18 per cent tax (as reverse GST) even in the case of services offered by non-GST registered vendors.

Emerging technology trends

LED lighting is going to open up immense possibilities not only by lowering energy consumption levels but also enhancing the overall lighting experience with respect to control, monitoring/sensing and connectivity, coupled with the convenience of longer life and improved aesthetics. Survey participants shared some insights about emerging technology trends that will shape the LED lighting market in India. Here is a collation of their views.

- Smart connected LED lights will be the next big thing: Lighting systems will get smarter, as the possibility of autonomous, self-commissioning illumination systems is emerging. The industry has been transformed from analogue to digital as LED lighting allows users to control, monitor and measure lighting output. This transformation is taking place across public, home and professional lighting, and the smart connected LED lights will emerge as the largest IoT device segment within the next five to ten years. Control devices, dimmers and wireless lighting with advanced sensors will cater to the needs of modern consumers.

- Changes in ‘on board technology’: This will happen through the use of IC based drivers to support touch based technology, which is the need of the hour for smart lighting systems. This will also reduce the number of components compared to those used in traditional drivers. Use of fewer components can reduce costs while enhancing the efficiency of the final product.

- Use of Chip Scale Packaging (CSP) or ‘Flip Chip’ packaging technology: This will enhance lumen output and also increase the reliability of the final product. Use of CSP eliminates the traditional sub-mount, directly attaching the LED die to the PCB, allowing for overall system cost reductions.

- Introduction of driverless low voltage direct current (LVDC) operated products: This will enable energy saving by reducing AC-DC current conversion losses. It will also make the products compatible with solar photovoltaic systems, helping them run as LED-solar hybrid systems, which will be quite effective in India.

- Shift in manufacturing techniques from through-hole to surface mount technology (SMT): This will enhance efficiency while reducing operational costs. This, in turn, will help achieve break-even points quickly, in spite of a relatively higher capex.

Moving forward

We asked the survey participants to discuss the immediate challenges that could derail the growth of this industry in India. Here is a collation of their opinions.

- Mushrooming low quality, unauthorised manufacturing units making sub-standard products, and low cost Chinese imports of poor quality could result in low consumer confidence.

- Lack of awareness among consumers as well as institutional buyers about the efficiency of LEDs with respect to lux, wattage, life expectancy, etc. This results in the use of products with higher wattage but lower efficiency.

- The inability to make LED chips and micro-chips, resulting in their being imported at high cost. This also limits the development of a wider variety of LED light fixtures, reducing the number of colours used, apart from hampering performance and crippling innovations in LED lighting.

- Absence of a sufficient number of LED packaging units, resulting in a high dependence on imports.

- Use of inefficient drivers, resulting in higher energy usage as well as product failure.

- An acute shortage of experts from fields like chemical, electronics optics, lighting and thermal management, all of whom are required for manufacturing LED chips.

Successfully resolving the above mentioned issues through appropriate industry initiatives and government intervention will not only help the LED lighting industry to achieve sustainable growth but also help the country to move towards greater self-sufficiency in power generation. This will make more power available to the public, so that within the next two to three years, electricity can reach even the far-flung hamlets and the hutments of the poor, many of whom have never seen any artificial light other than oil lamps.

Major contributors to this report

- D. Christopher, GM, ELCOMA

- V. Sudarshan, MD, Spectrum Techvision Pvt Ltd

- Parimal Rajkunwar, director, Macon Power Pvt Ltd

- Vijay Kumar Gupta, MD, Kwality Photonics

- V.P. Mahendru, chairman and MD, Eon Electric Ltd

- Anirudh Kajaria, business head, Century LED

- Avinash Goel, head-technical, development and sourcing, Opple Lighting India Pvt Ltd

- Devashish Ganguli, DGM, Havells Lighting